Analysis with

the System

Sync trading system by Julien Moog.

Disclaimer: this website and all its content is for informational purposes only. Not investment advice.

System Sync

A highly profitable trading system by Julien Moog

This system will give you profitable signals on any markets. You can use the free MetraTrader 4 software and copy all

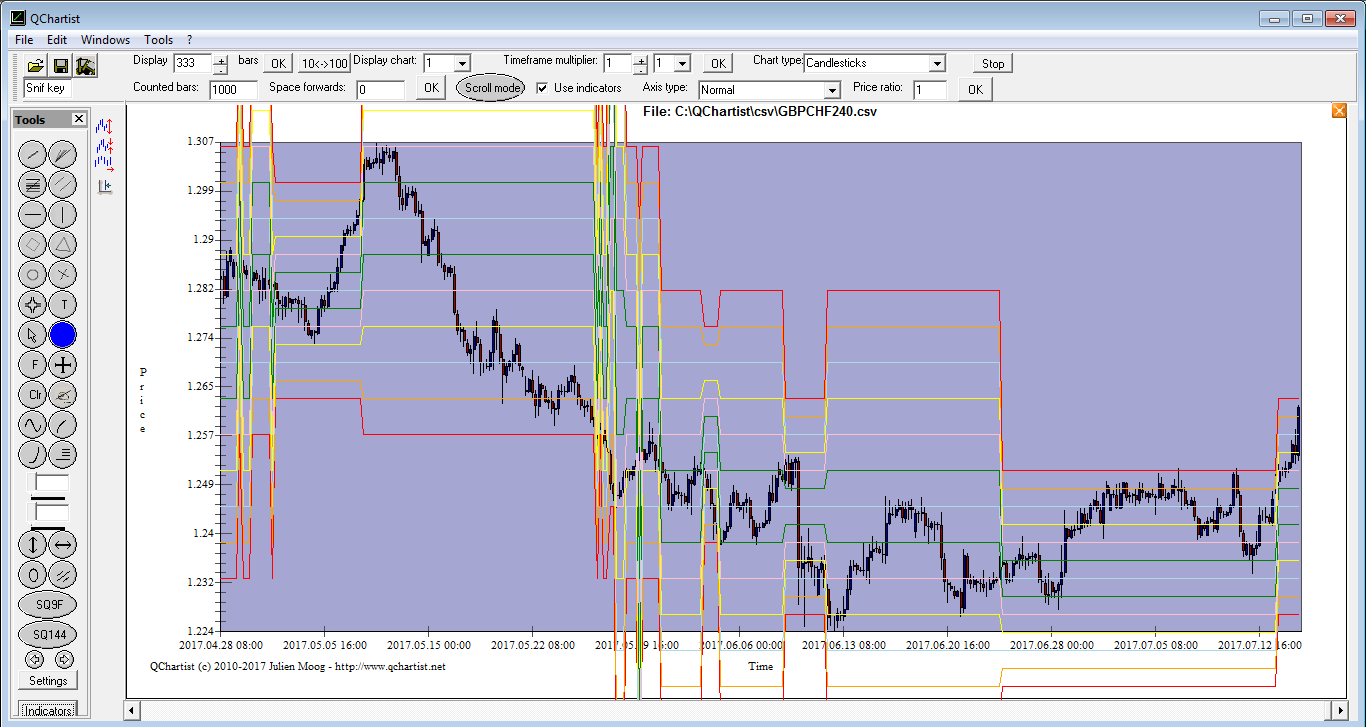

the following indicators and templates into the software. Or you can also use the free QChartist software.

This system is the fruit of many years of market research and efforts.

This system is complex, signals may be rare, but are very accurate and reliable.

First download and install MetaTrader 4 and configure it with the broker of your choice.

Brokers is recommend: Oanda MT4 demo account, JFD Brokers MT4 demo account, FXPro MT4 demo account and eToro real account to operate.

List of MT4 indicators needed:

- Vegas Currency Daily 1 Hour2

- ADR lines Shinigami v1.1

- ADR lines Shinigami v1.12

- ADR lines Shinigami v1.13

- ATR_Channels

- BB - HL (Per=200)

- bowels

- Center of Gravity 1

- Center of Gravity

- fibo

- fibo2

- ftvcprdl

- Ichimoku

- j_tpo

- MA Chanels FiboEnv Mid

- Murrey_Math_MT4_VG

- Past Regression Deviated (LR.length=225)

- Past Regression Deviated Log

- realMACD

- Spectrometr_Separate

- Stepftvcprdl_v2

- StepRSI_v2

- Stochastic (5,3,3)

- StochasticRSI (RSILength=5 ; StocLength=5 ; WMALength=5)

- TD Sequential

- TMA (TimeFrame=60 and 240 ; Interpolate=false)

- TMA+CG (Interpolate=false and all alerts false)

- TSCD

- valuechartatrchannels

- Volatility.Pivot

- VWAP Oscillator

- Weighted WCCI

- SwamiRSI_v1

- ZUP_v66

- WeeklyPivot

- MonthlyPivot

- CoronaTrendVigor_v2.1

- CyAn_1_Fty (lenth=3)

- MACDonRSI

- RD-Combo

-

Directional Volume Index (50,50,5)

List of MT4 templates needed:

- !BABON1H

- !PRD_WWCCI

- !system_sync

- !Corona

- 0tmacg

- JM cog

- !MA C W Pivot

- jm adr murrey

- !Channels

Download the trading system with indicators and templates here:

https://www.qchartist.net/trading_system/trading_system.zip

Mirrors:

http://www.mediafire.com/file/k7m7c70fgot6d5a/trading_system.zip/file

https://www.4shared.com/zip/JcPeVeURiq/trading_system.html

https://drive.google.com/file/d/1o1hIThoKJcKxpXJ1fbto5bsjH0zV3Dbz/view?usp=sharing

https://1drv.ms/u/s!All-V4E8LsNLgjzA-fE717vshad0?e=bQd9yv

https://sourceforge.net/projects/qchartist/

Then copy the .mq4 and .ex4 indicators in MT4 indicators folder

Copy the .tpl templates in MT4 templates folder

Restart your MT4 software.

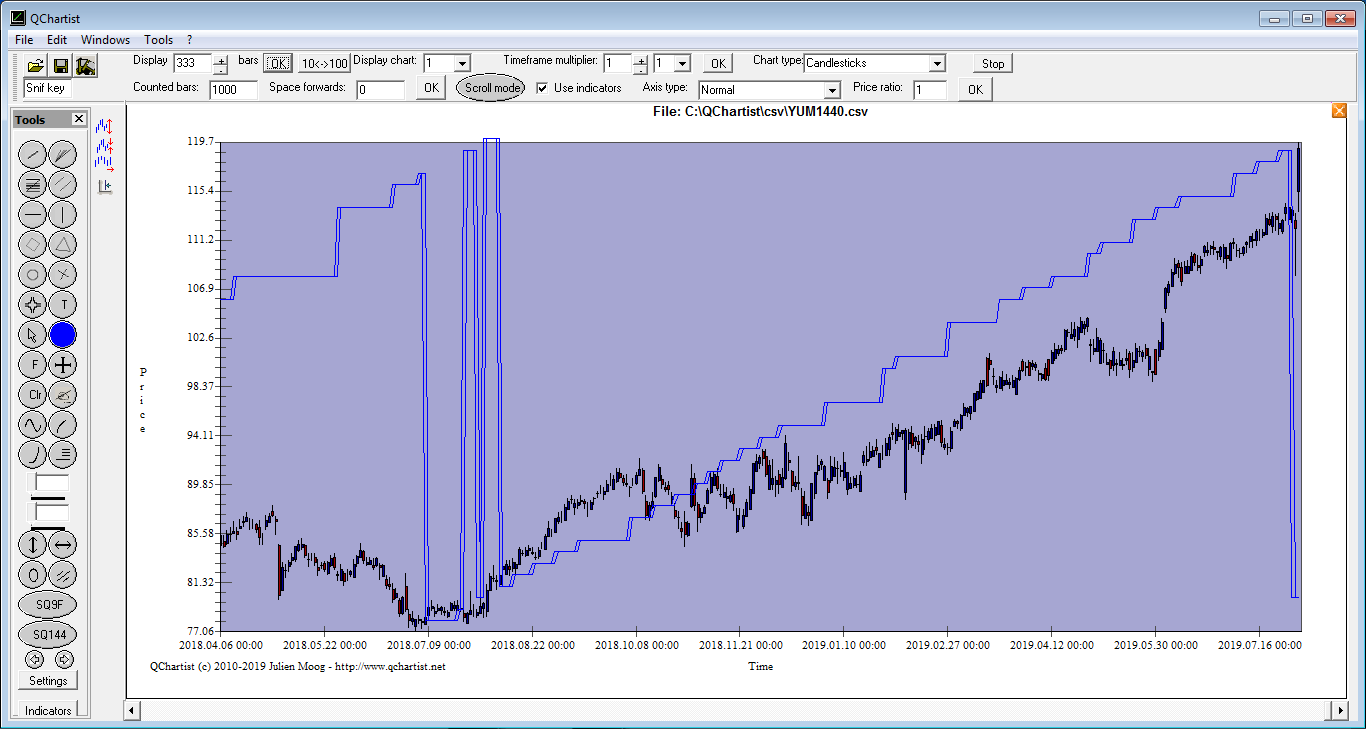

You will also need to use the Jupiter Saturn Cycle + planetary lines + planet scale + planetsqn indicators available in QChartist software.

Download and install QChartist from

http://www.qchartist.net/download.php

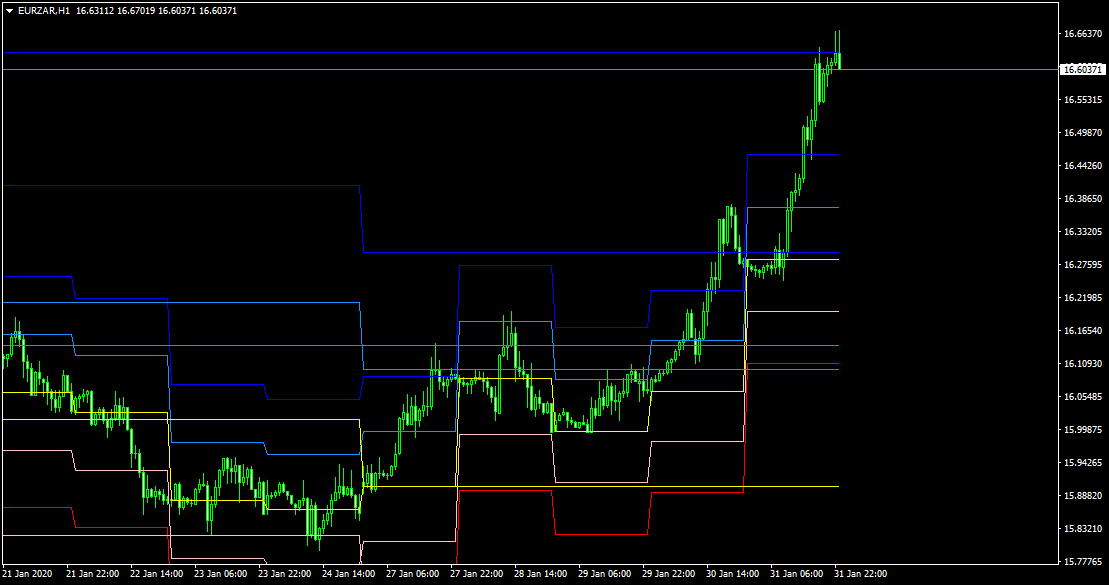

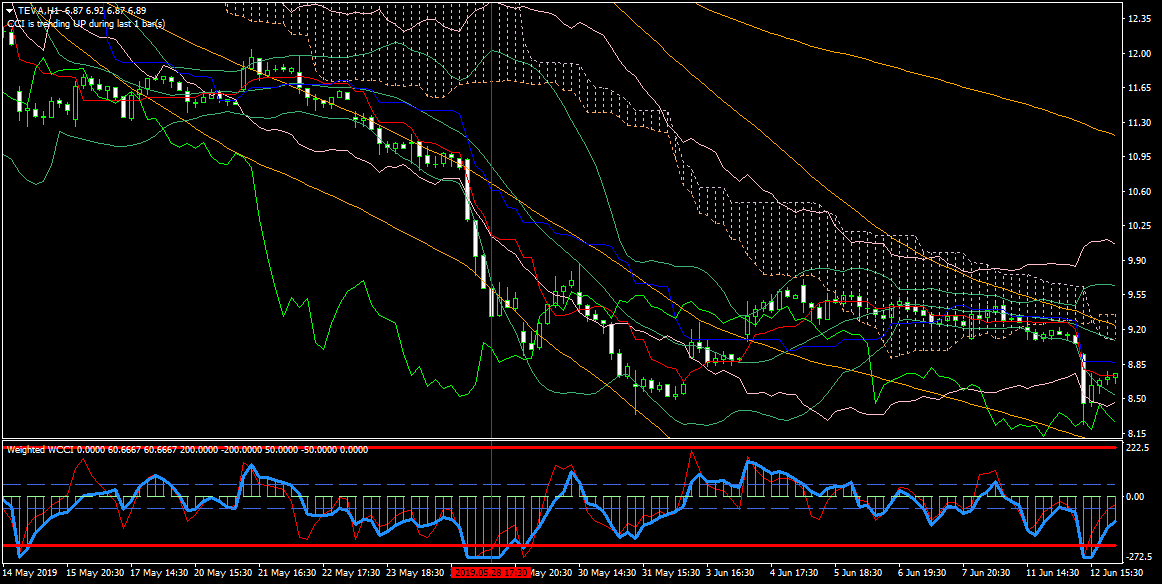

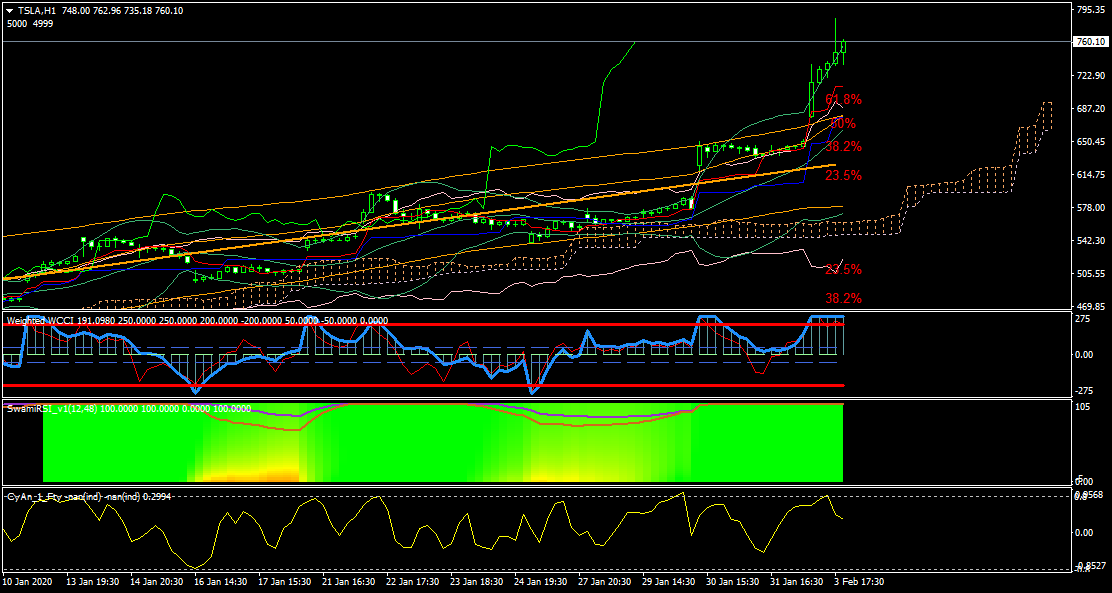

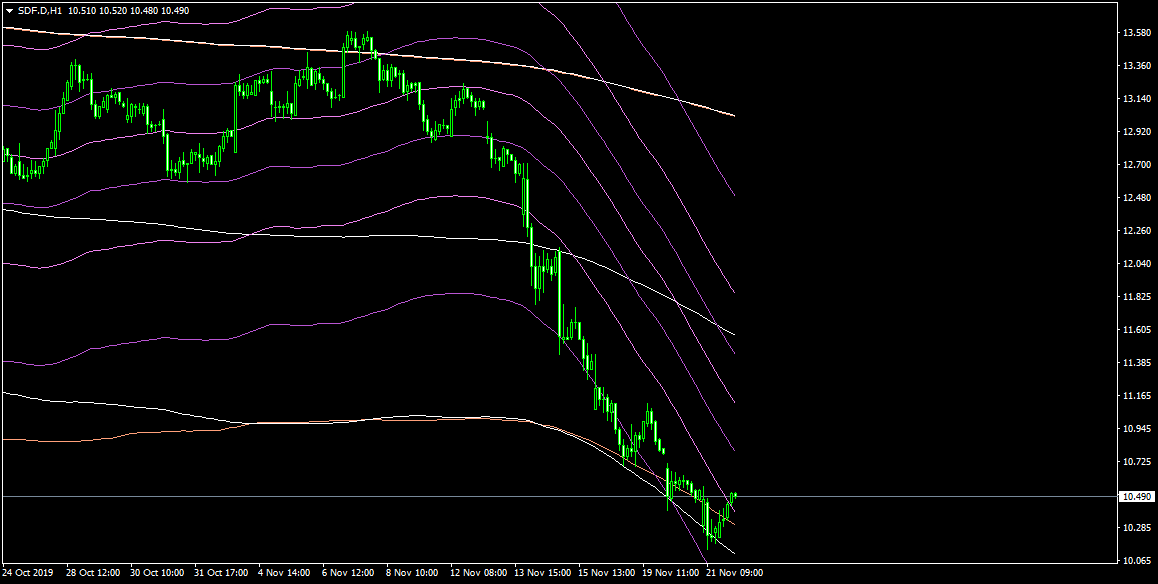

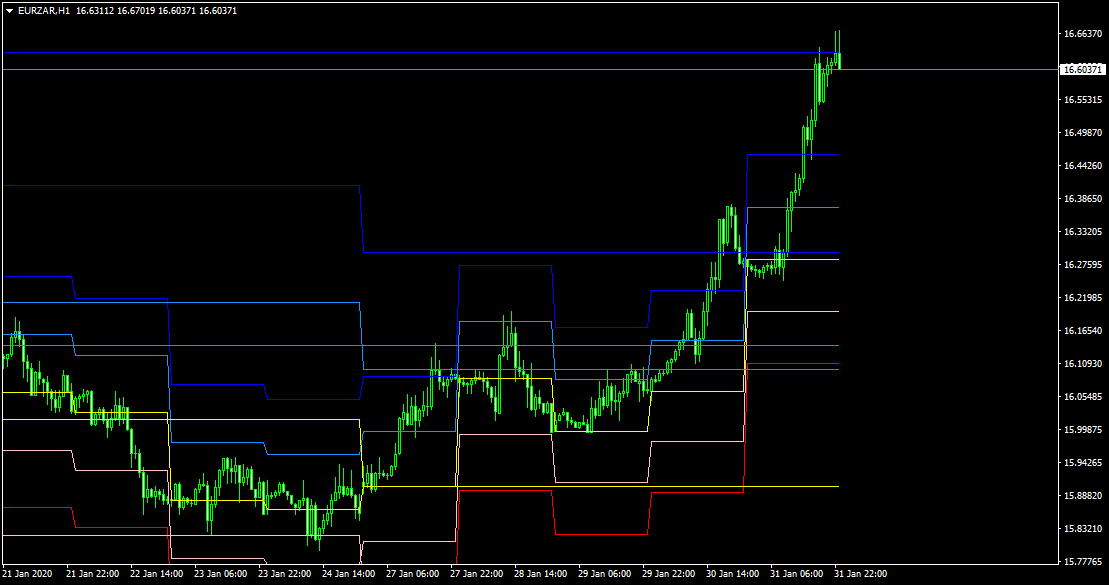

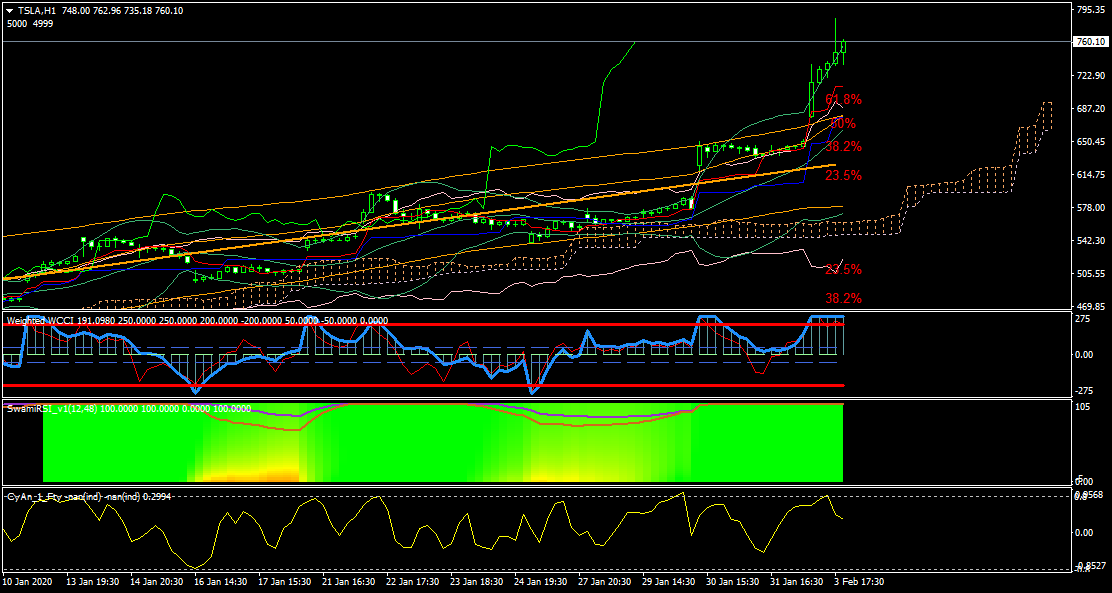

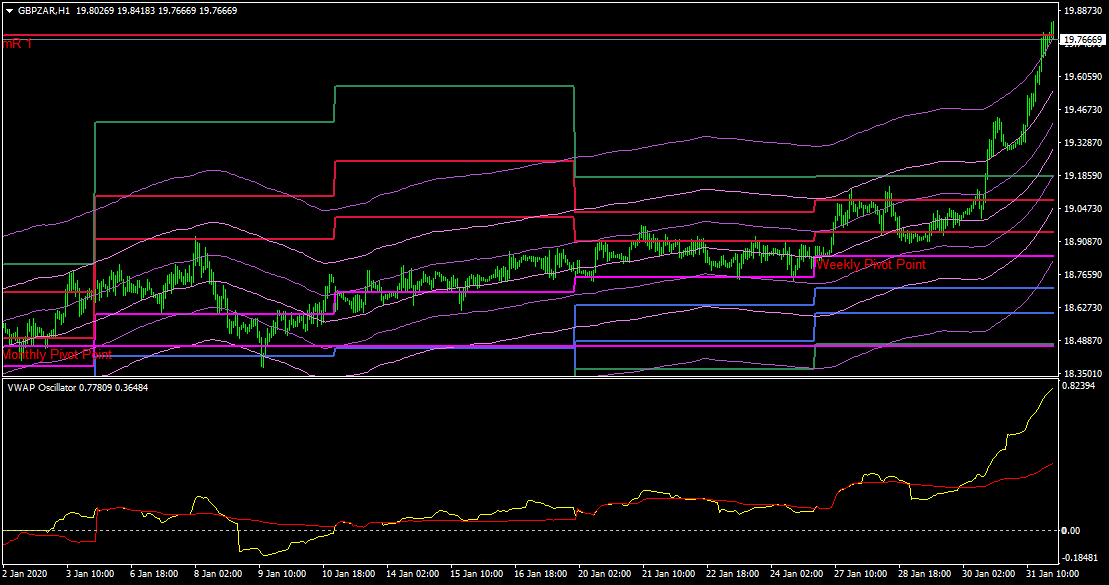

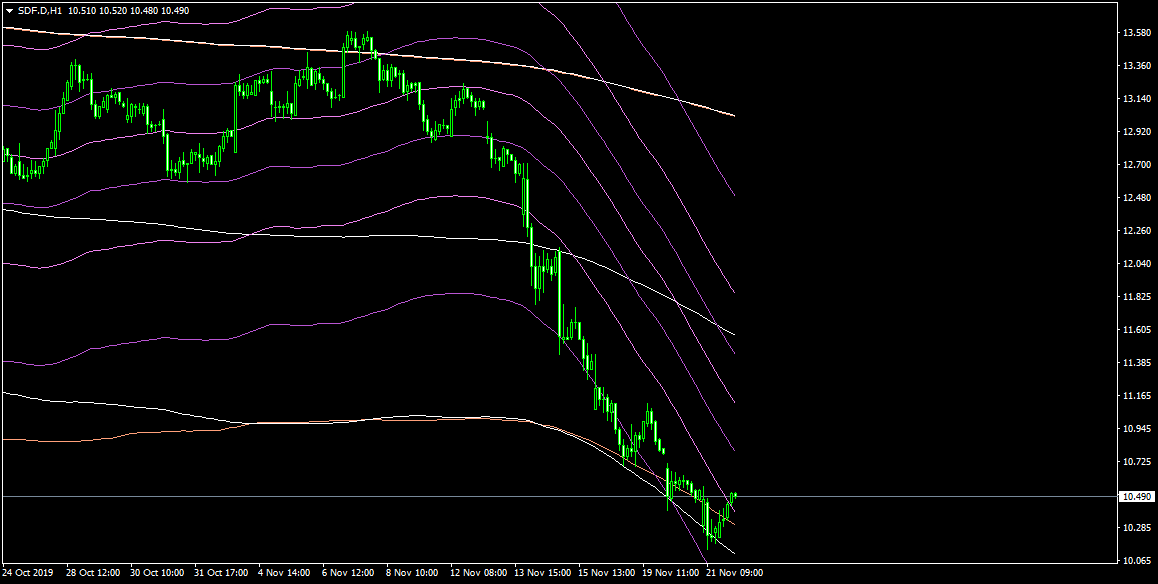

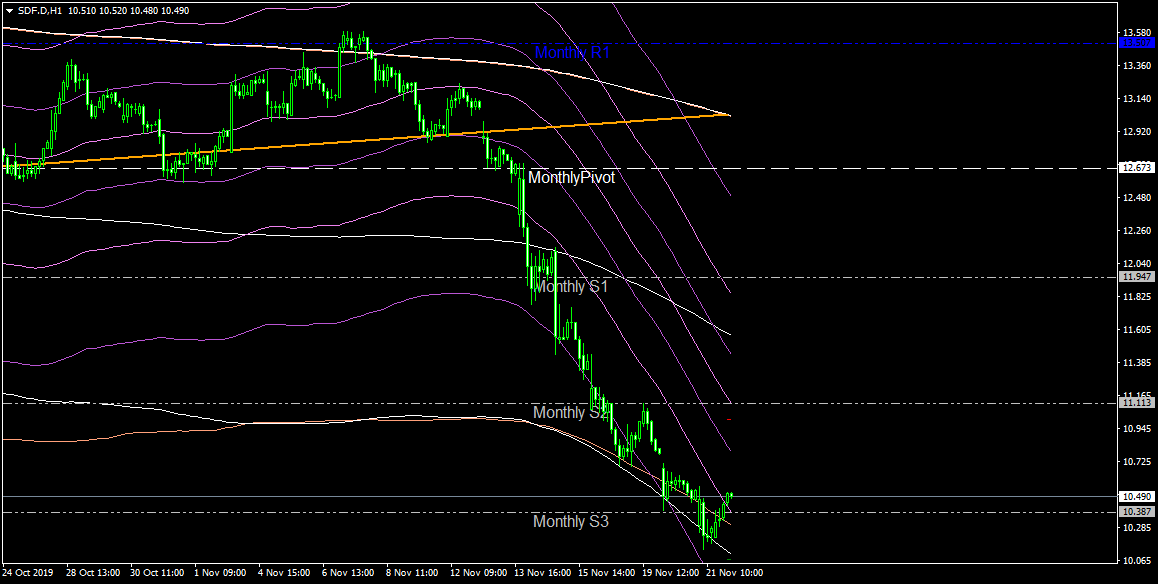

Entry (please use H1 timeframe):

- With template !system_sync: price is on the the Average Daily

Range (ADR 1.1) blue marine line imperatively

- With template !system_sync: price is on the the Average Monthly

Range (ADR 1.13) blue marine line or MonthlyPivot R1-3 or S1-3 (TPL !MA C W Pivot)

- With template !system_sync: price is above the Average Weekly Range

(ADR 1.12) yellow line

Interesting:

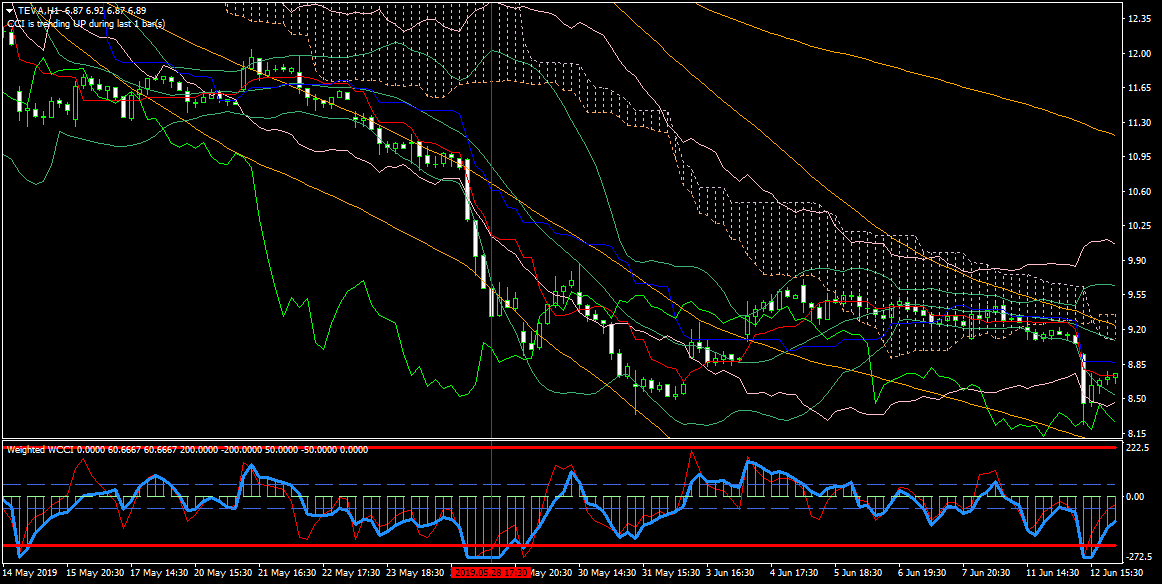

- With template !PRD_WWCCI: price is near past regression deviated

(orange) higher band, fibo (orange) higher band and atr channel (pink)

higher band

- With template !PRD_WWCCI: Weighted WCCI blue thick line is on

the higher red line

- Ichimoku cloud trend up if we sell, trend down if we buy

- Bollinger Bands on upper or lower band

- With template !PRD_WWCCI: SwamiRSI_v1 is stuck on the upside or downside imperatively

- With template !PRD_WWCCI: CyAn_1_Fty is near 0.8 or -0.8

- With template jm adr murrey: price is >= the orange +1/8 Ove

orange

line of Murrey Math on H1, H4, Daily, Weekly or Monthly timeframe

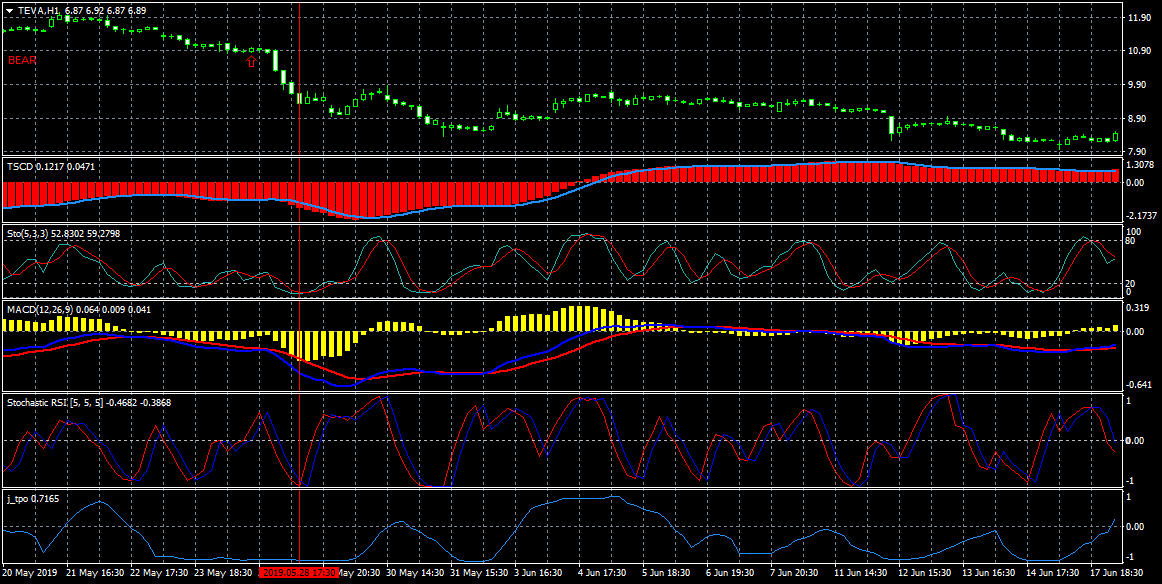

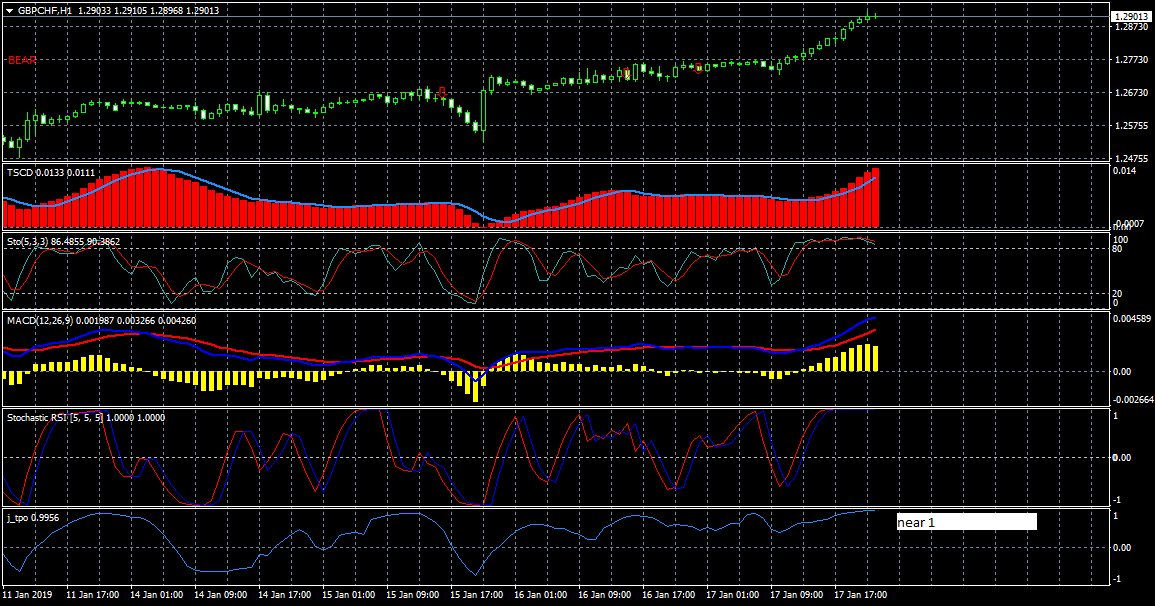

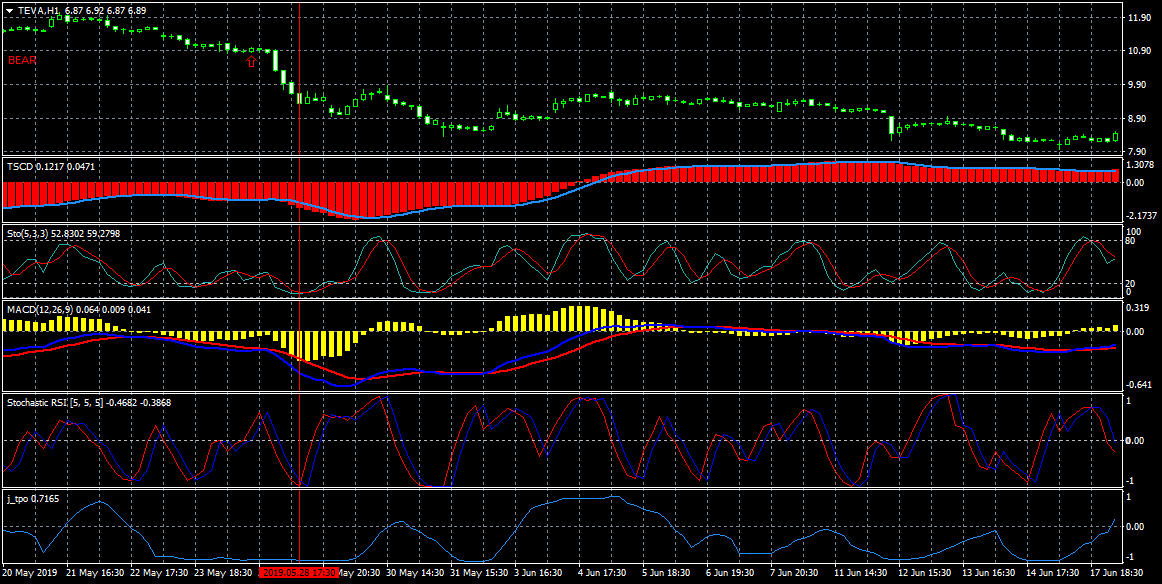

- With template !Corona:

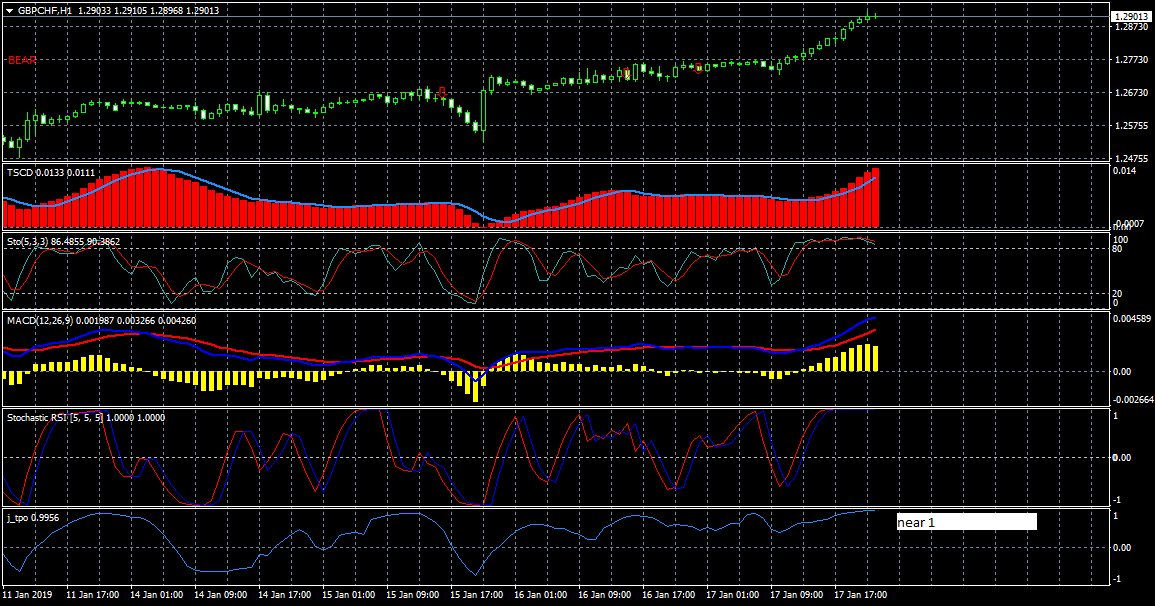

- With template !Corona: TSCD

red histogram > < 0

- With template !Corona: Stochastic 5,3,3 near 80

- With template !Corona: RealMACD blue line is at least as high as the

yellow histogram

- StochasticRSI is at -1 or 1

- j_tpo > < 0

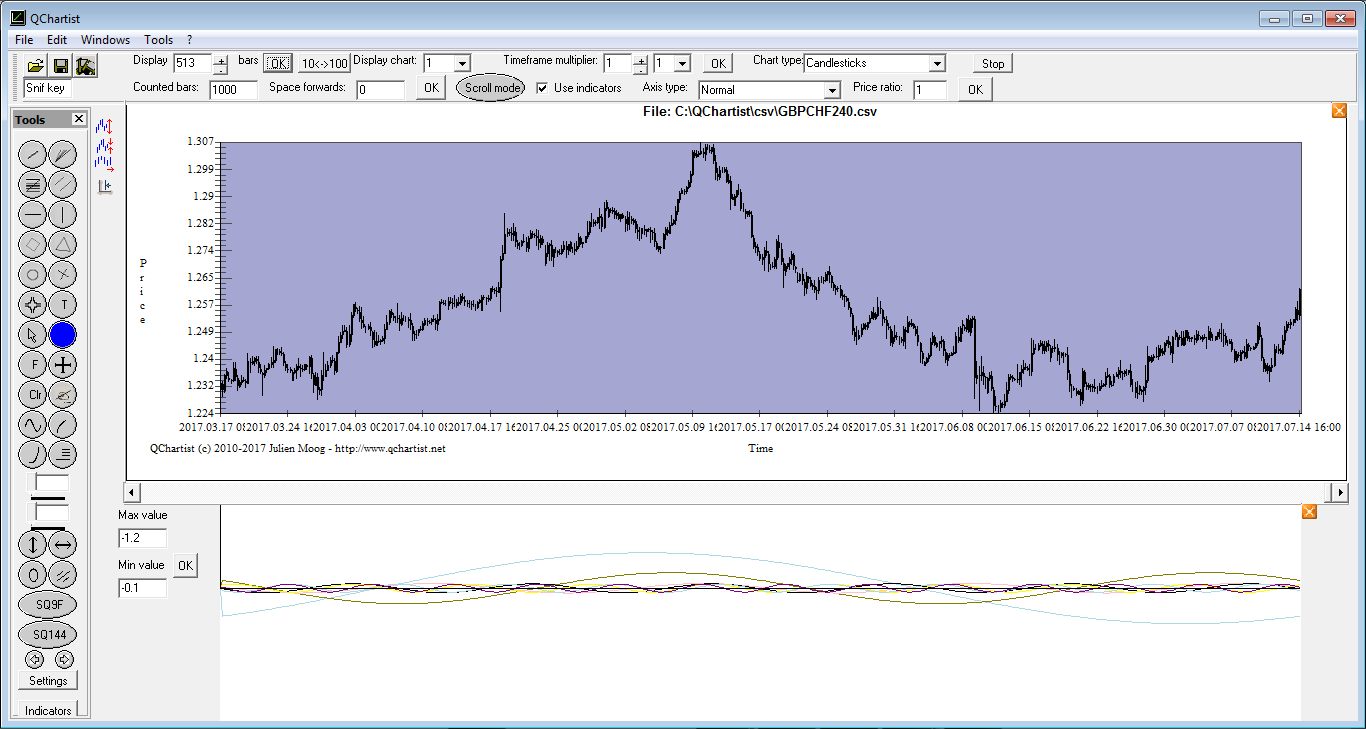

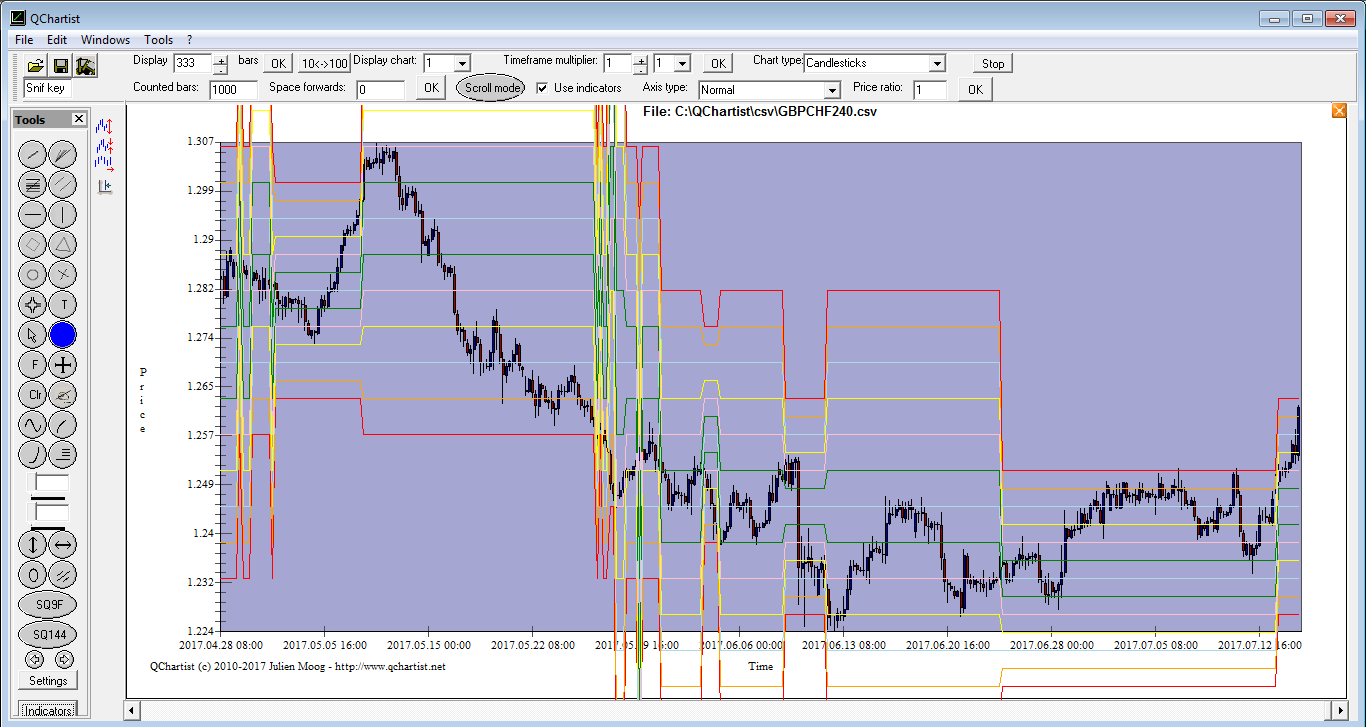

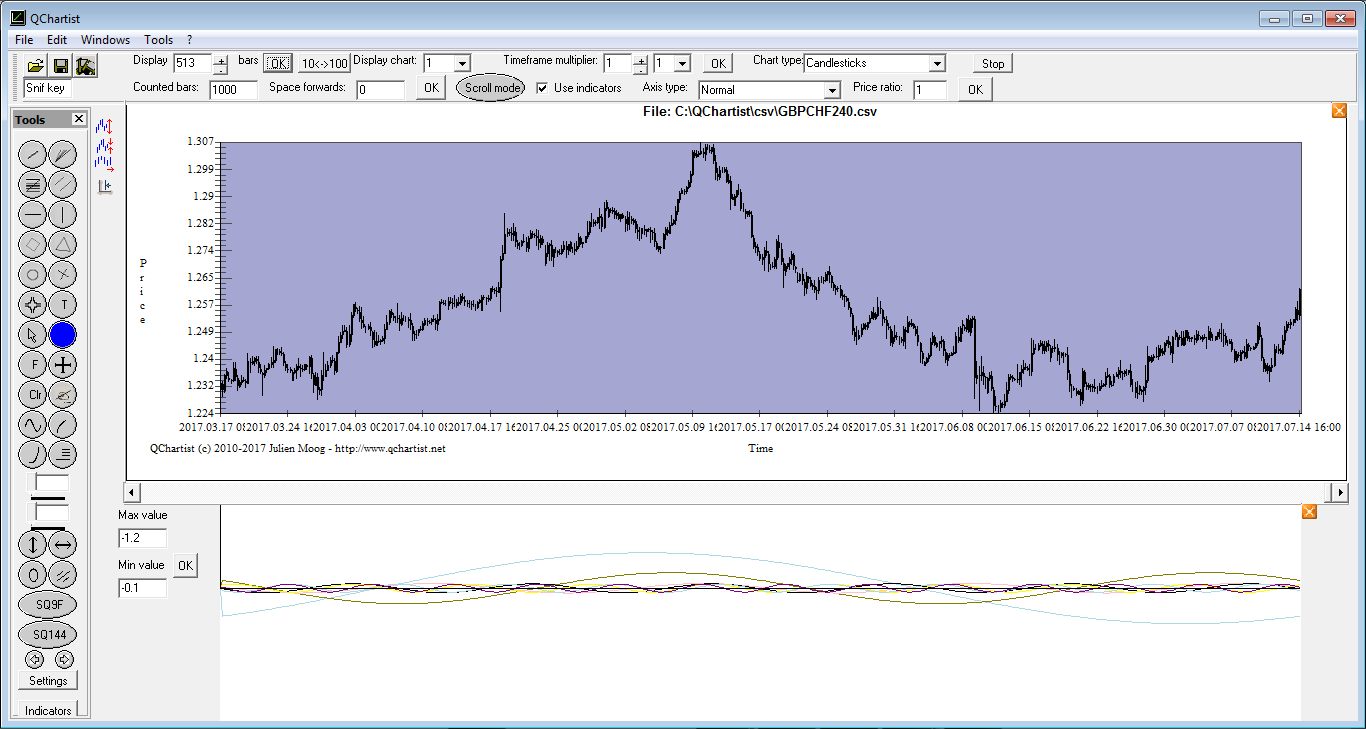

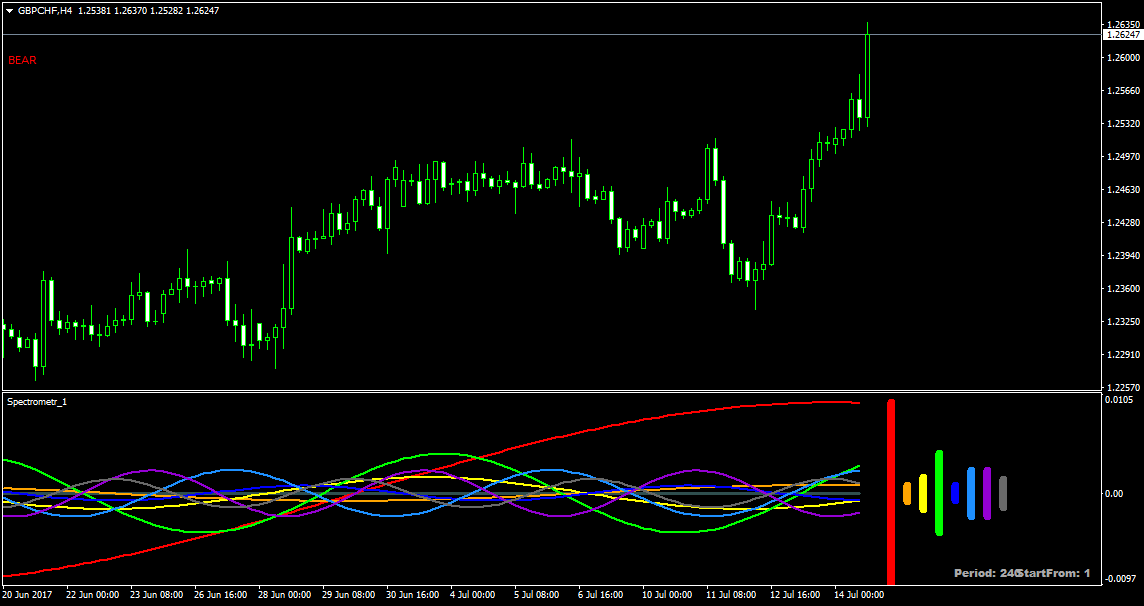

- One of the 2 sinusoids with the highest amplitude is pointing down (QChartist fftspectro indicator) (1 hour to monthly TF)

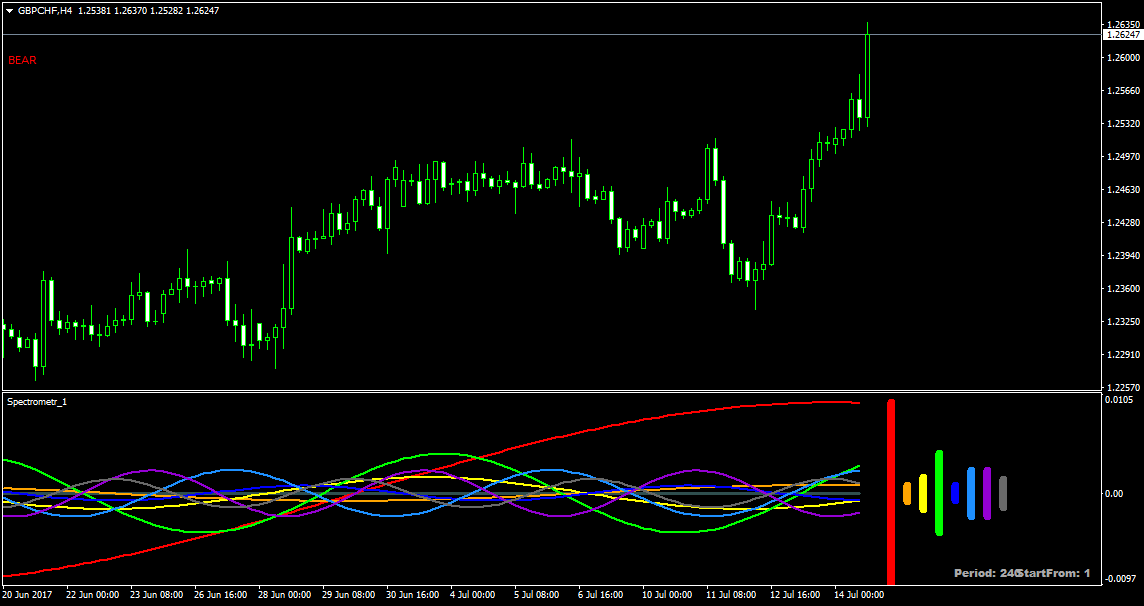

- The sinusoid with the highest amplitude is pointing down (red) (MT4 spectrometer_separate indicator)

- If sinusoid with the highest amplitude is not pointing down (MT4 spectrometer_separate indicator) but the 2nd sinusoid with the highest amplitude is pointing down, fftspectro sinusoid with the highest amplitude must point down.

- Optional but advised:

- You should use the Center Of Gravity on TF Daily or Weekly or Monthly to see if the direction of the trend is OK. (not required)

Don't trade against the trend.

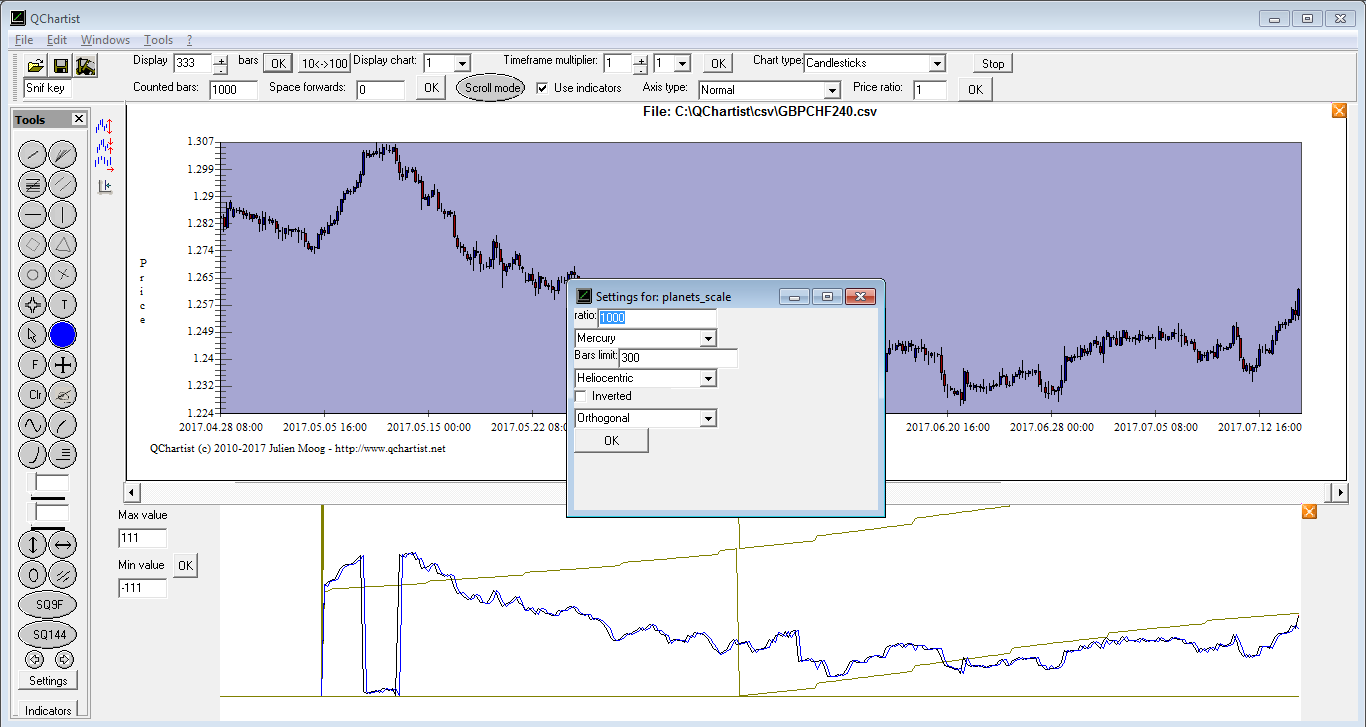

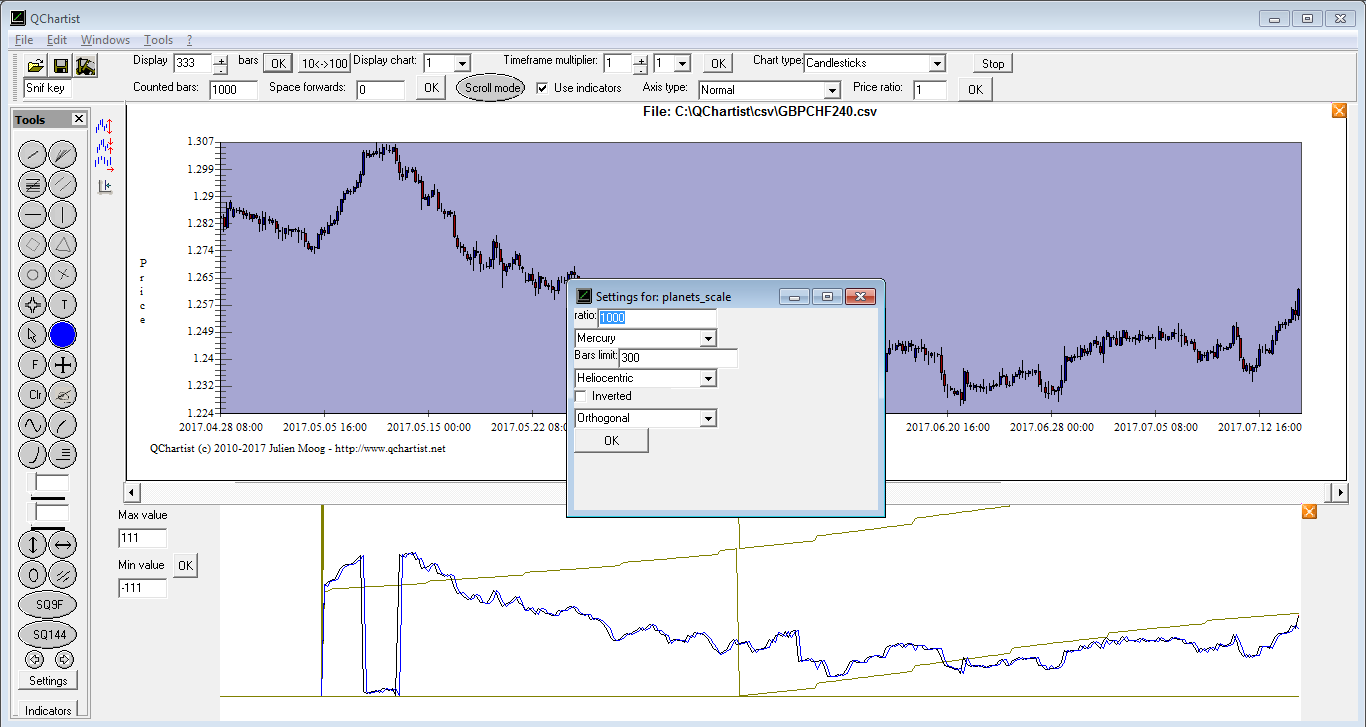

- With the QChartist software: detrended price is near a line of the

Mercury or Venus or Earth indicator (resistance) (planet scale indicator)

If it is not the case, PlanetSqn on Daily TF or Jupiter - Saturn Cycle on Daily TF or Moon Scale on H1 can do the job.

In order to open the .csv MT4 charts from QChartist, you need to export

.csv files from MT4 history center.

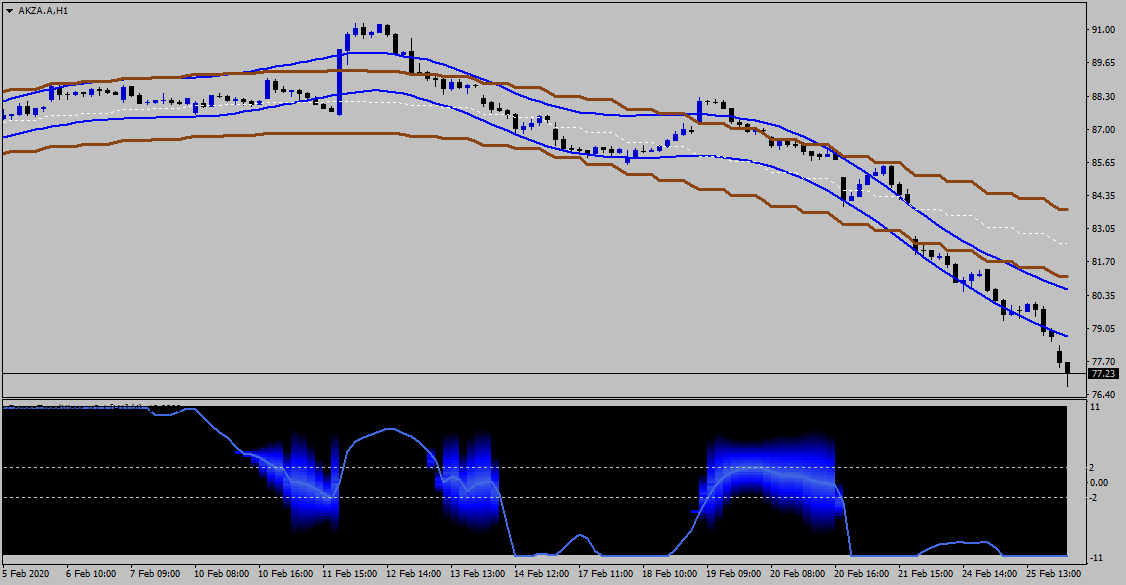

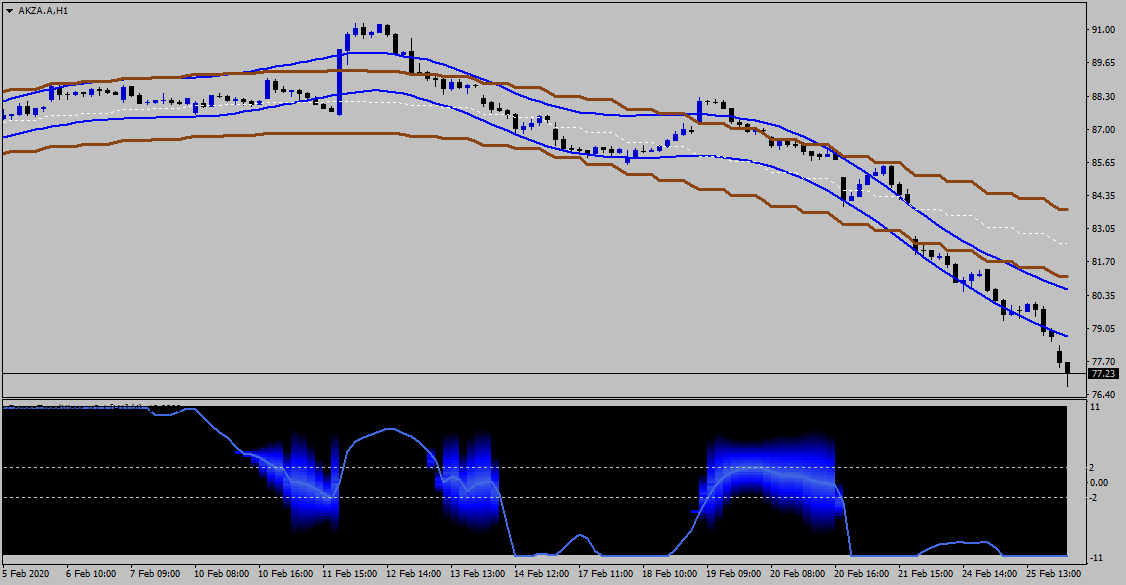

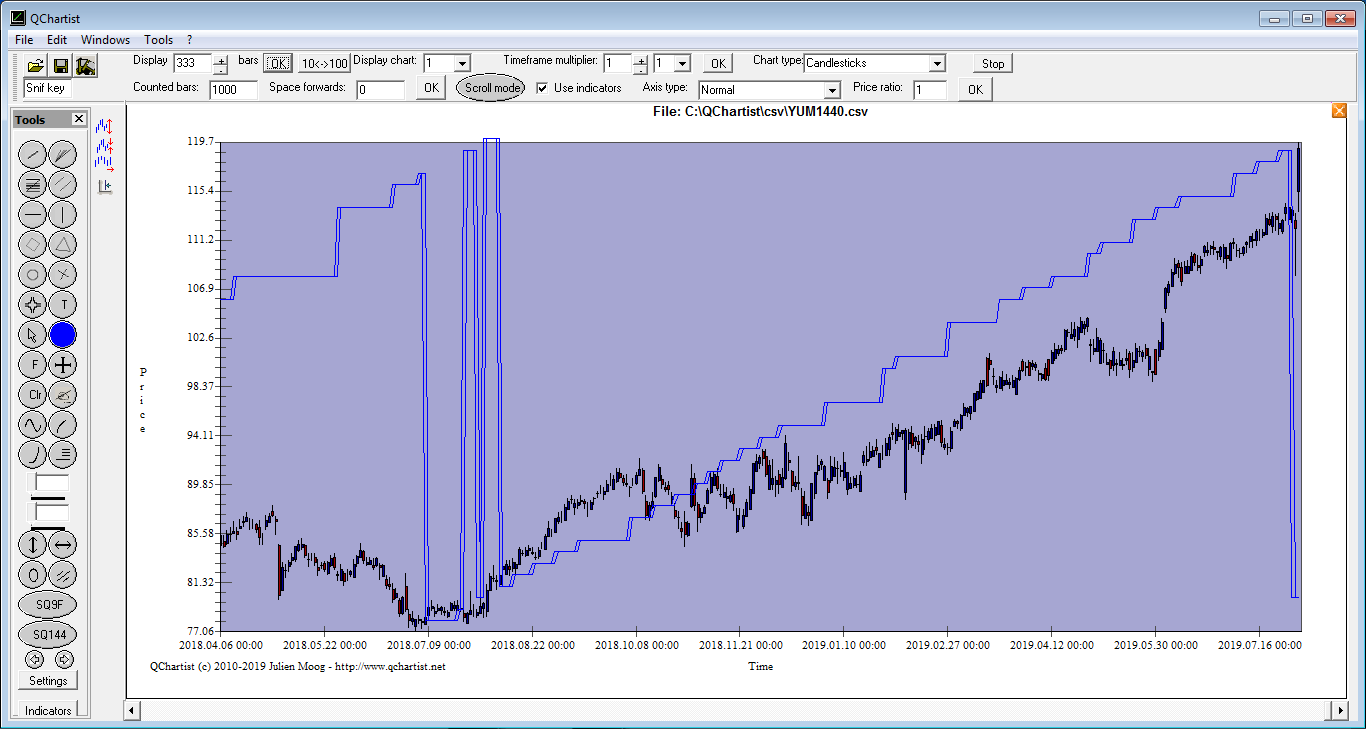

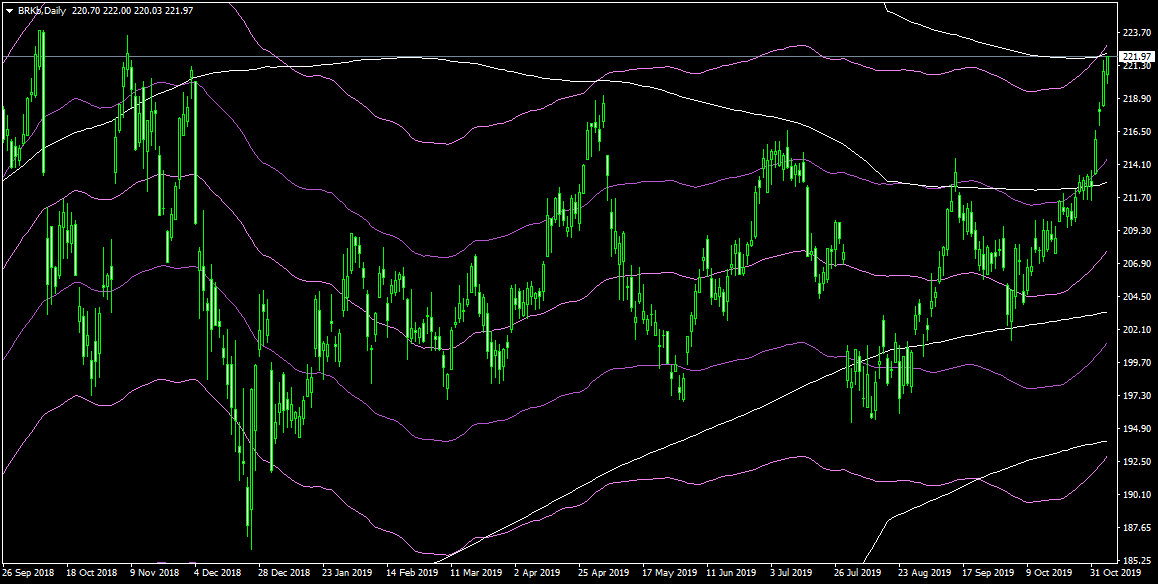

- You can also use the TMA indicator to detect tops and bottoms with a timeframe of 240 set in the indicator settings (not required)

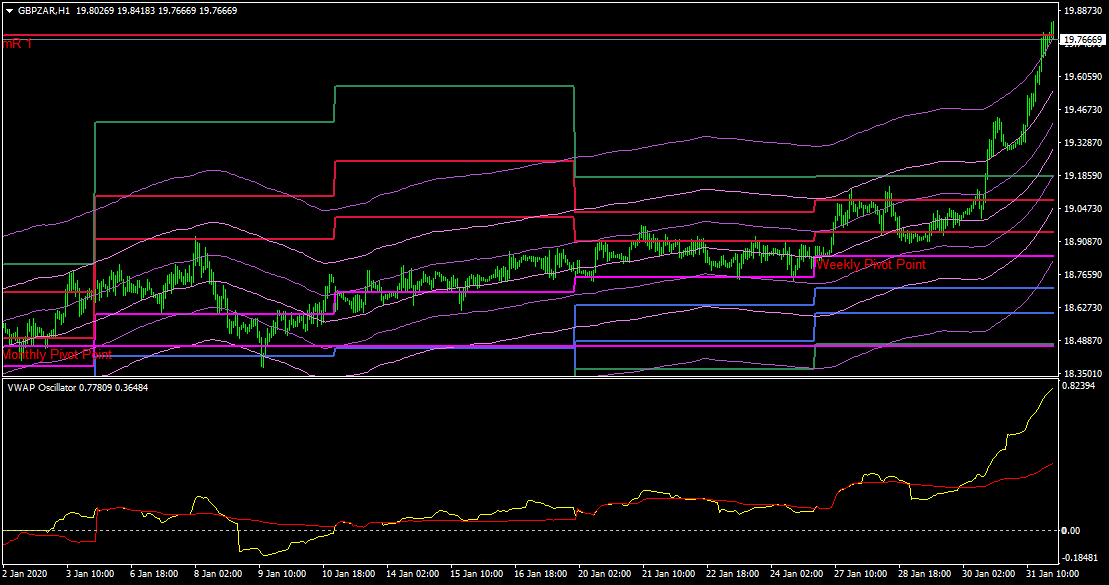

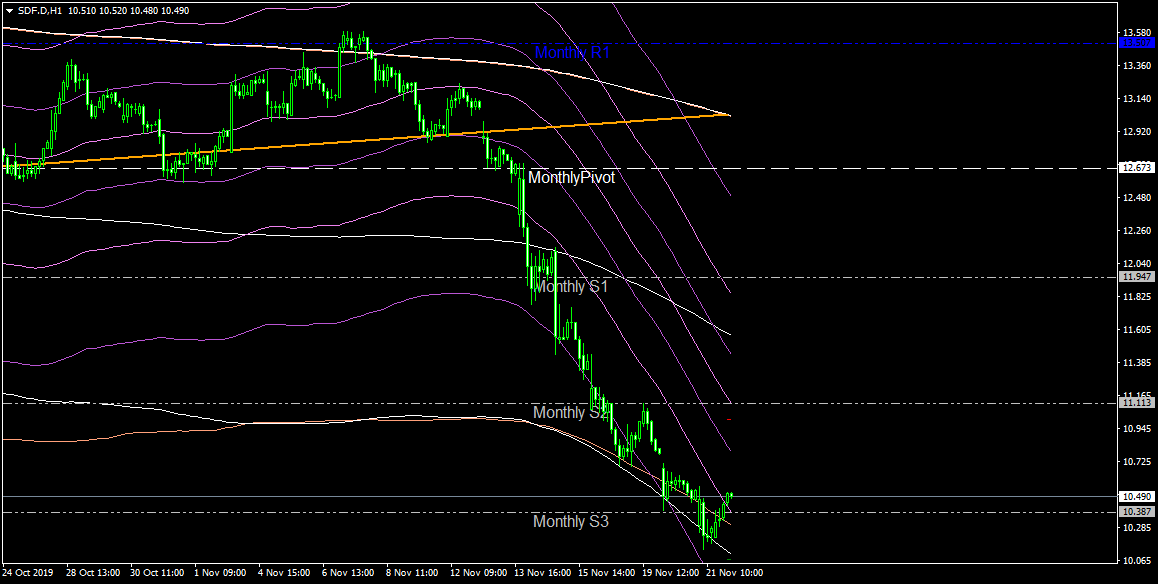

Example:

- The blue bottom enveloppe is below the marron bottom enveloppe

- The CoronaTrendVigor_v2.1 indicator is flat

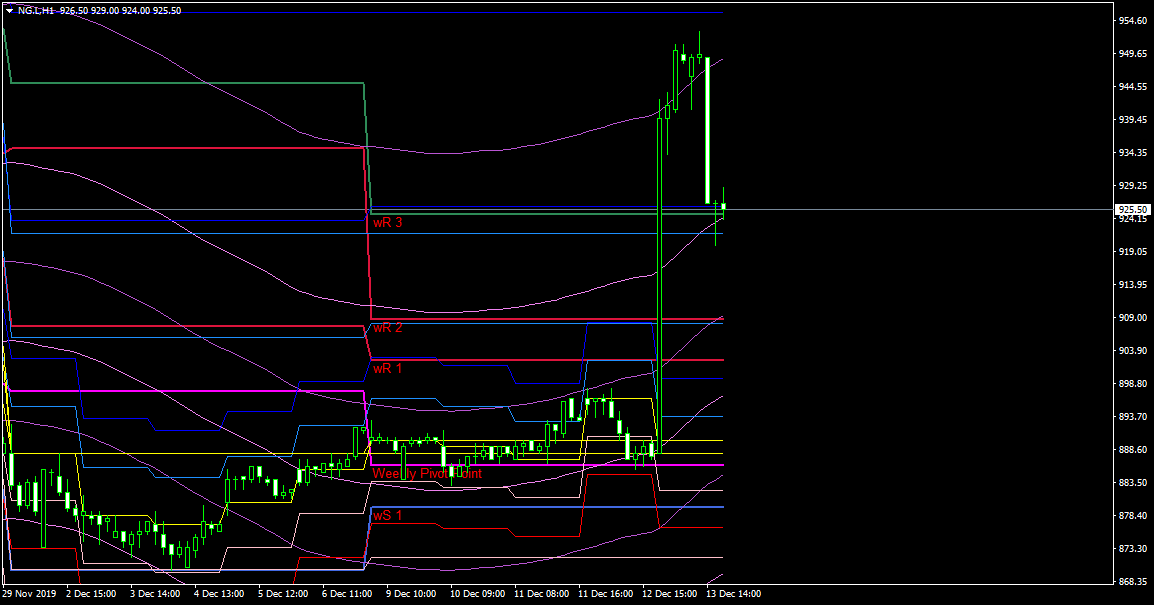

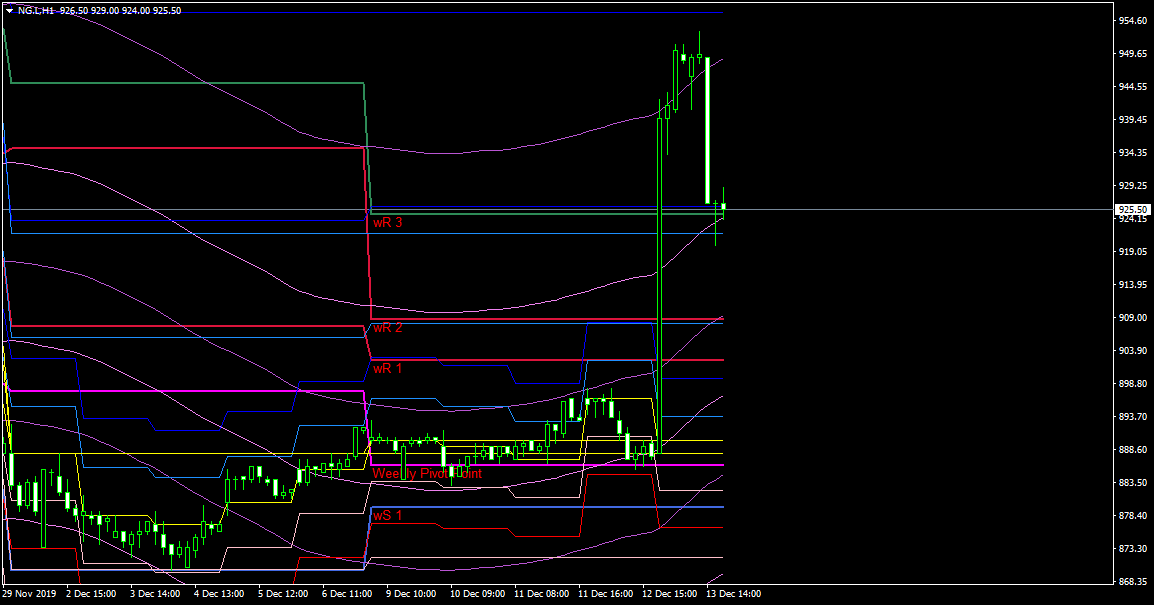

- With TPL !MA C W Pivot We are near the Weekly Resistance 3 for the current week or for the previous week

- With TPL !MA C W Pivot We are on the MonthlyPivot R1-3 or S1-3 for the current month or on the Average Monthly

Range (ADR 1.13 TPL !system_sync) blue marine line

- Price must be > MonthlyPivot violet line if we sell or price < MonthlyPivot violet line if we buy

- With TPL !MA C W Pivot We are on the last line of MA Chanels FiboEnv Mid imperatively

- With TPL !MA C W Pivot With VWAP Oscillator: the 2 lines are > 0 if we sell or < 0 if we buy

- You can also use BB - HL and Moon Scale to detect tops and bottoms

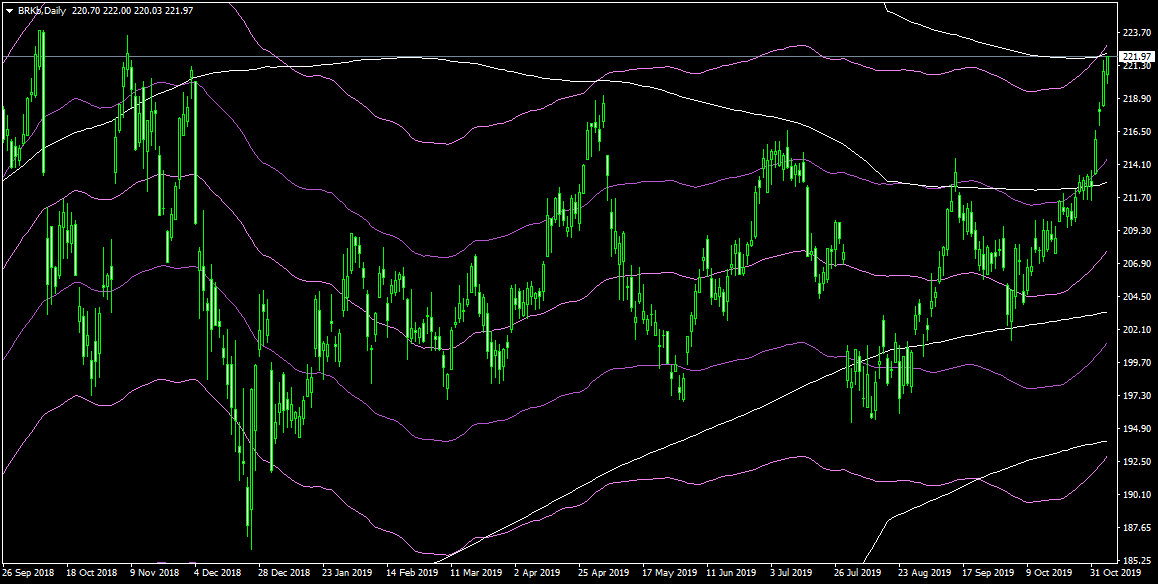

Example:

- With TPL !Channels: we are near the upper or lower band of BB - HL

If the price still goes into the wrong direction:

- Wait for a green bar of RD-Combo to enter one more time (highly recommended)

- Look at the 3 bands on daily or weekly charts ( BB - HL , Vegas , MA Chanels FiboEnv Mid) (Vegas is very useful)

- Look at Jupiter - Saturn Cycle or Planetary Lines Convergence

If the price still goes into the wrong direction:

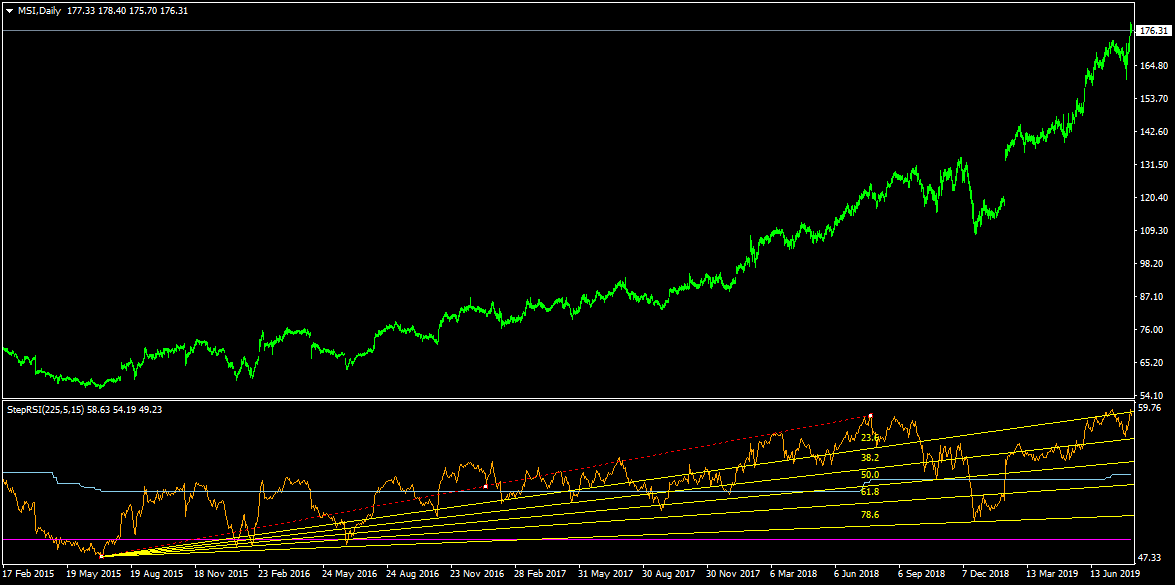

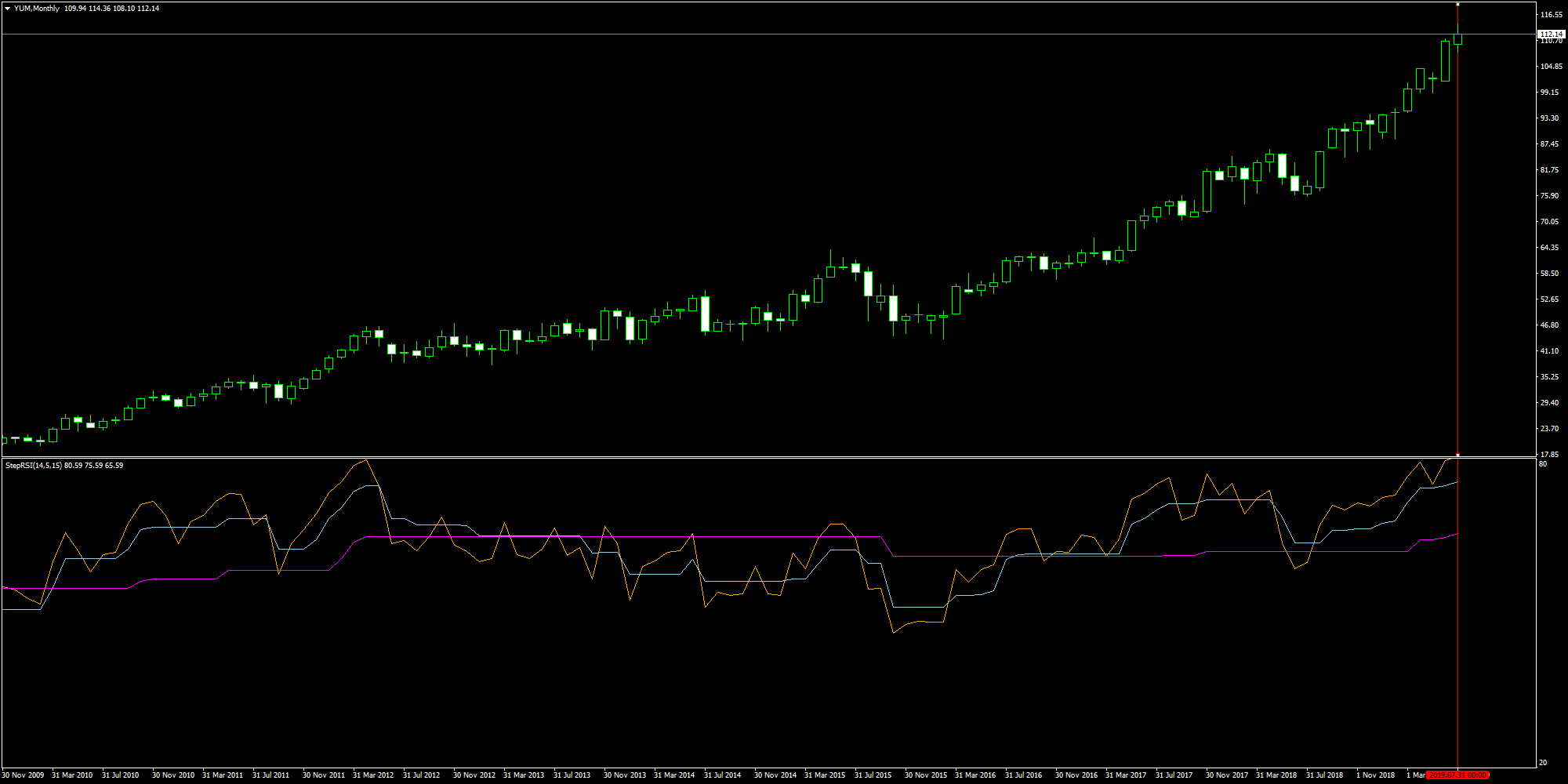

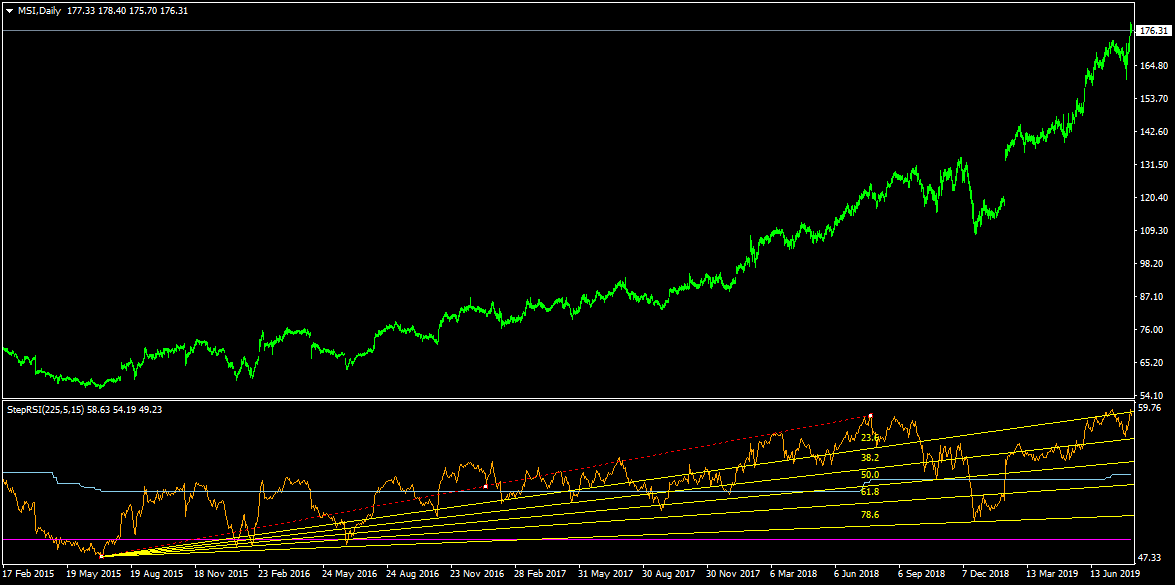

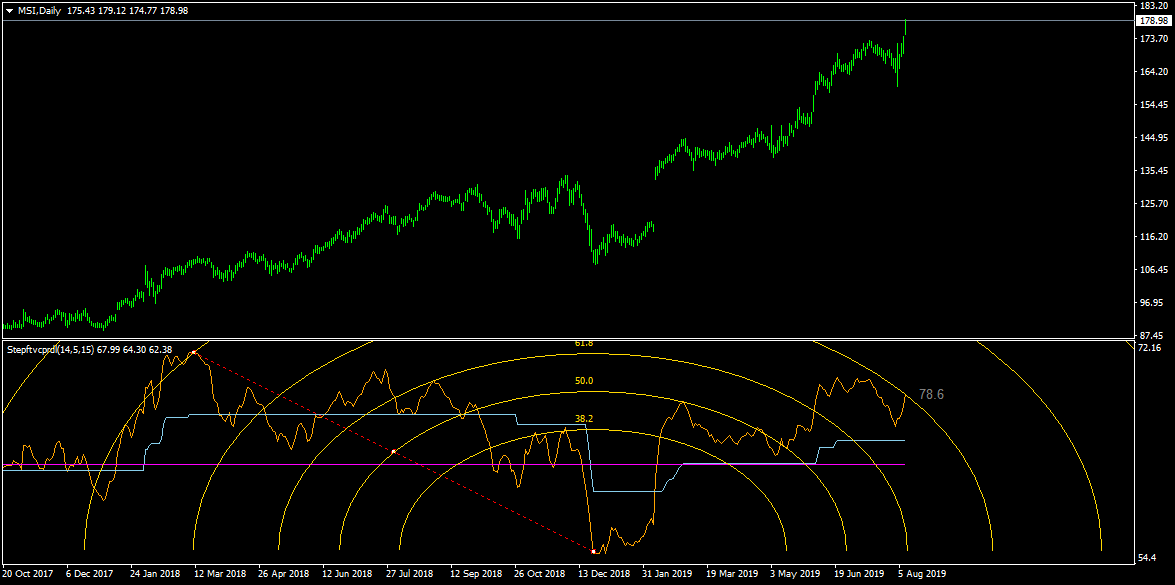

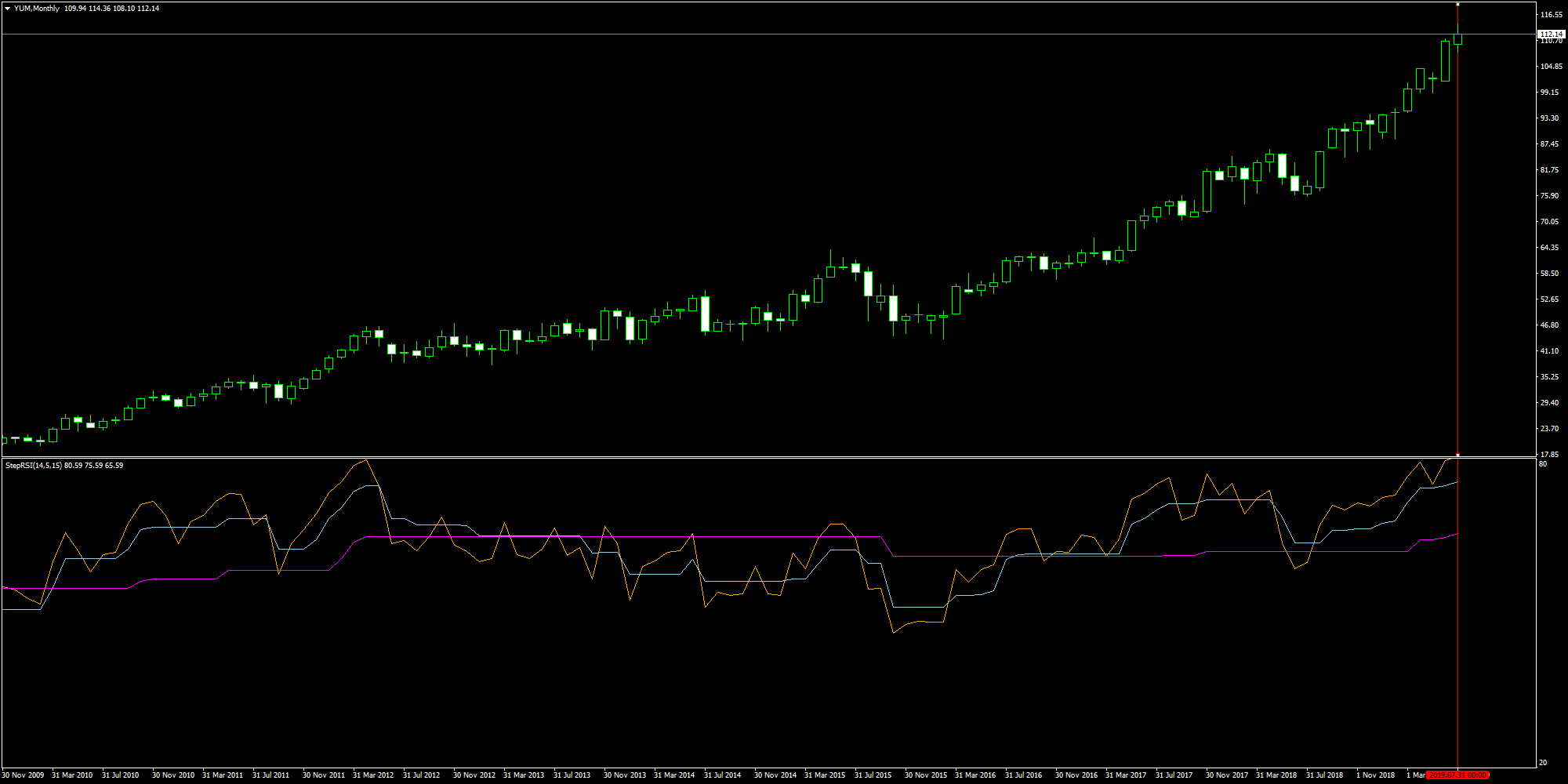

- Look at the previous bar of StepRSI_v2 on the weekly or monthly chart for >80 or <20 (not required)

If the price still goes into the wrong direction:

- Look at the Planetsqn indicator (Sq9Chapter15) (required if all other astro indicators are not ok) on the daily tf with Market Warrior or QChartist

- You can look at Past Regression Deviated Log (not required) with MA Chanels FiboEnv Mid

- You can look at Past Regression Deviated Log with MA Chanels FiboEnv Mid and BB - HL period 500 (Past Regression Deviated Log not required, BB - HL period 500 not required, but BB - HL period 200 and MA Chanels FiboEnv Mid highest or lowest band required)

(TPL !Channels)

- You can look at Monthly Pivots Points with indicator bowels (required if RD-Combo is not enough)

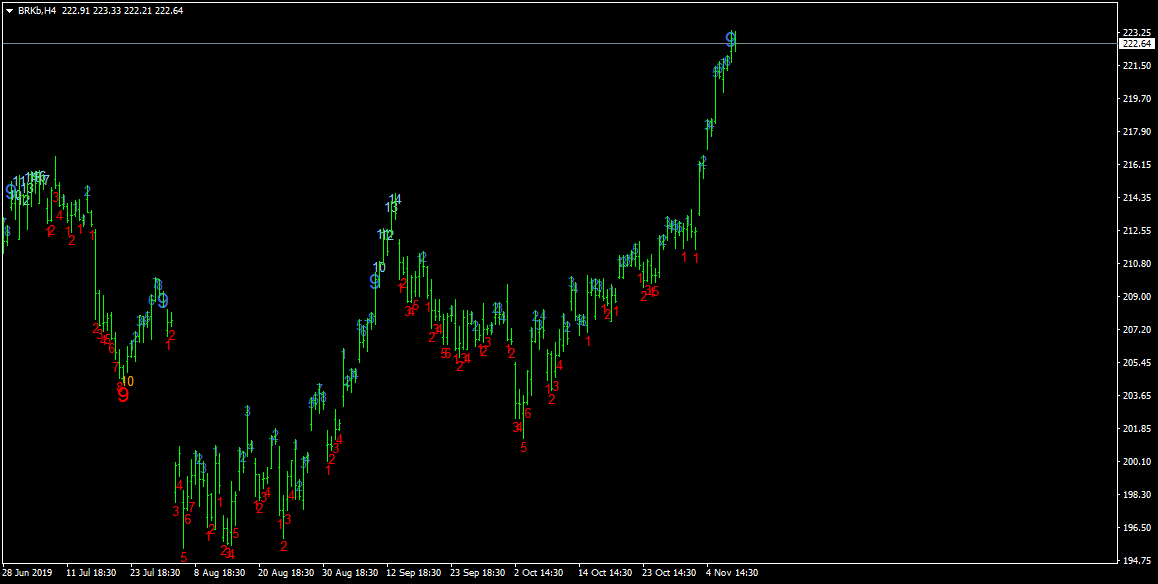

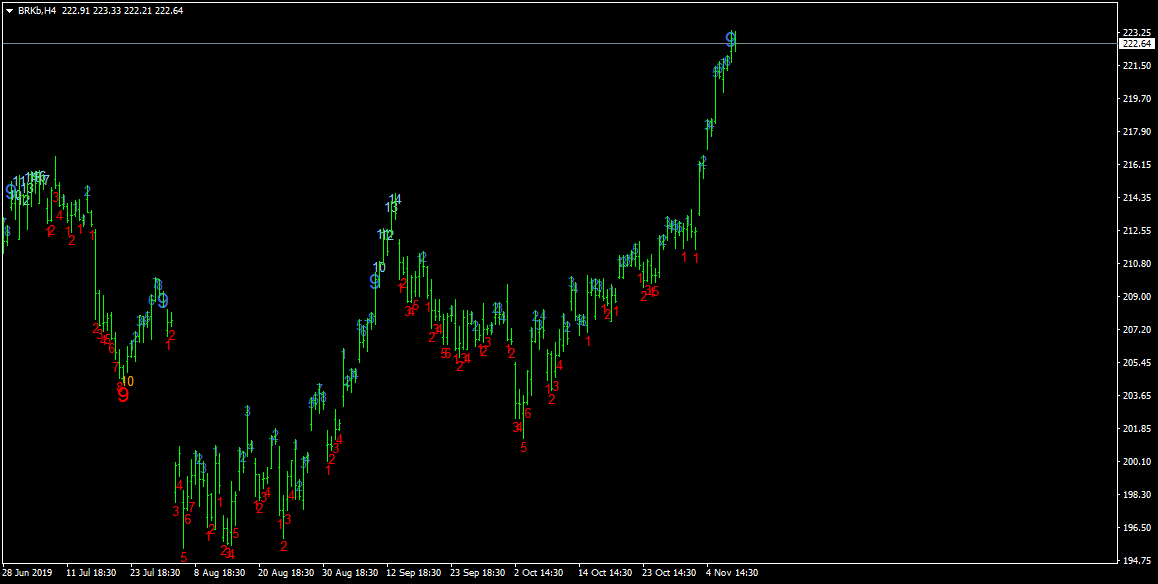

- You can look at TD Sequential if there is a 9 or a 13 (not required)

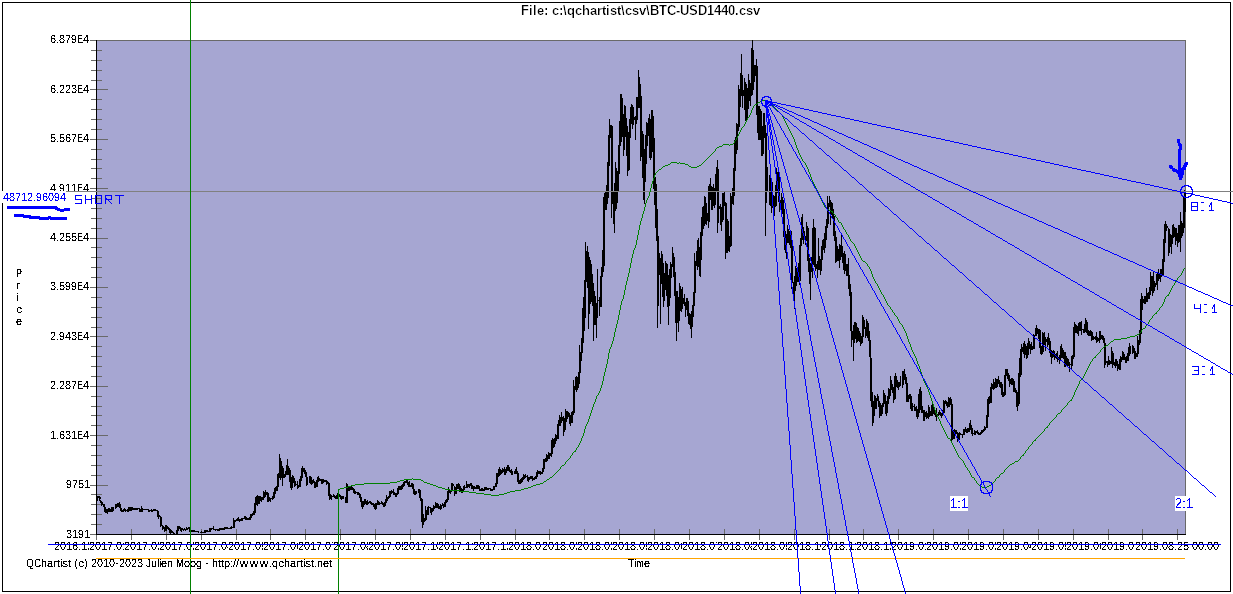

- You can look at ValueChartATRChannels with Fibo Fans and Pitchforks (not required)

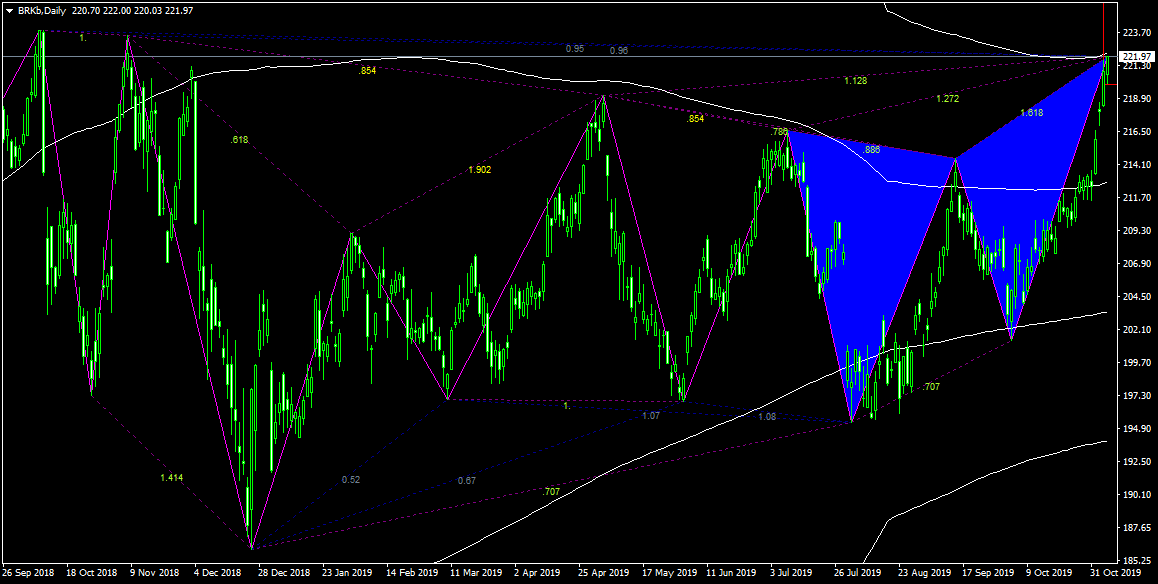

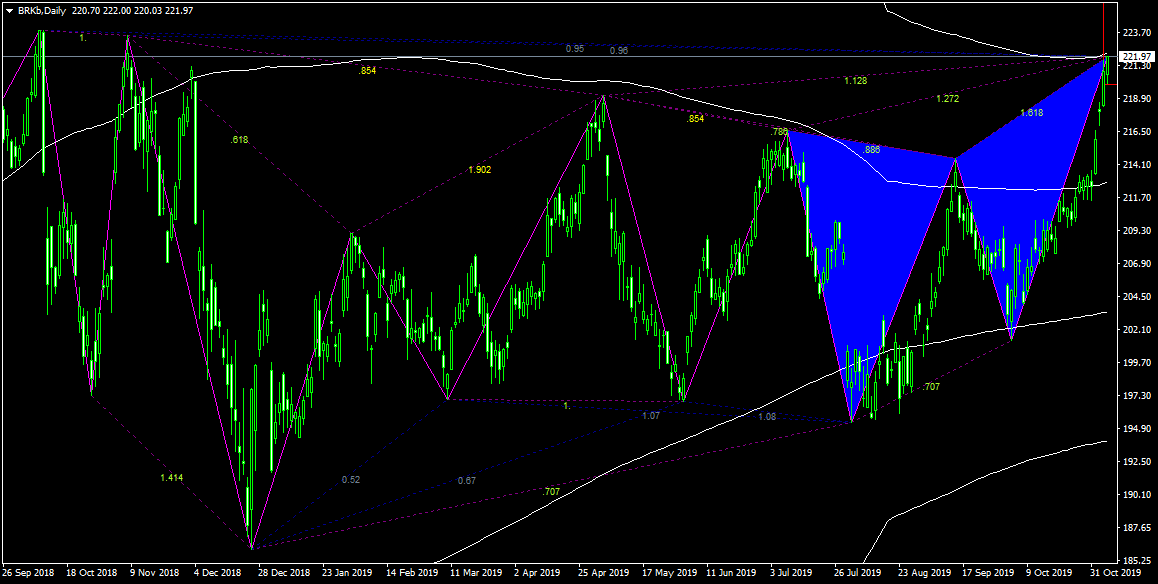

- You can look at ZUP for a butterfly (not required)

- You can look at ZUP for a butterfly (not required)

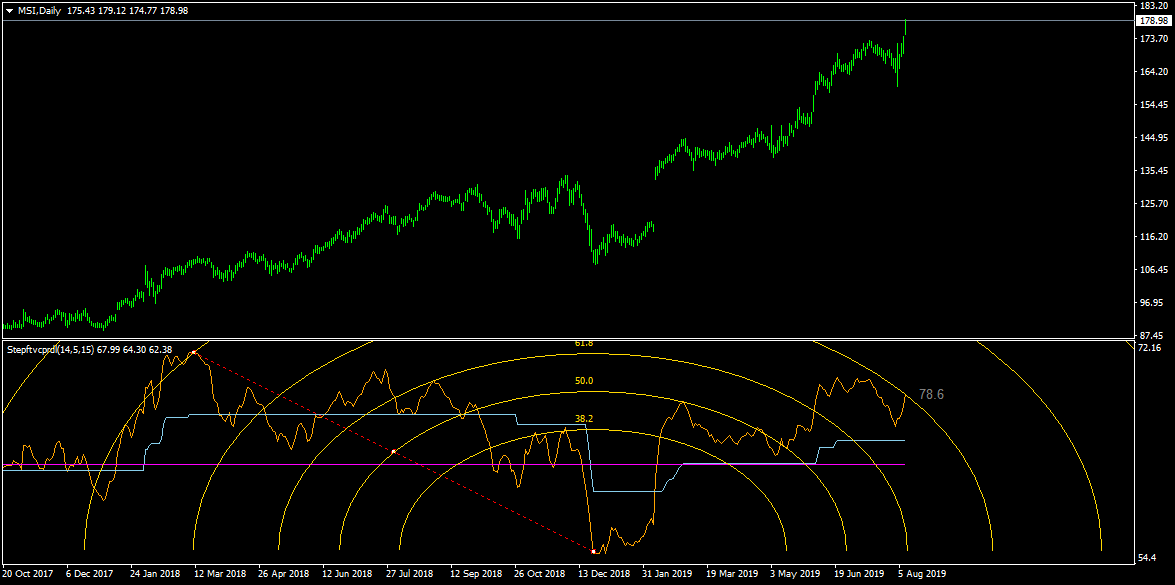

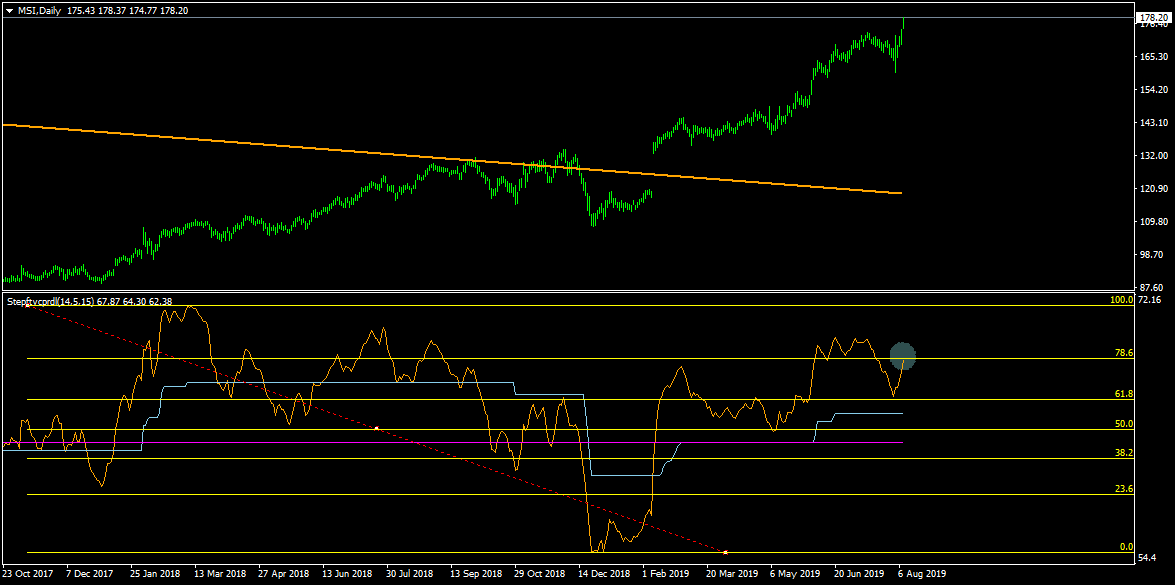

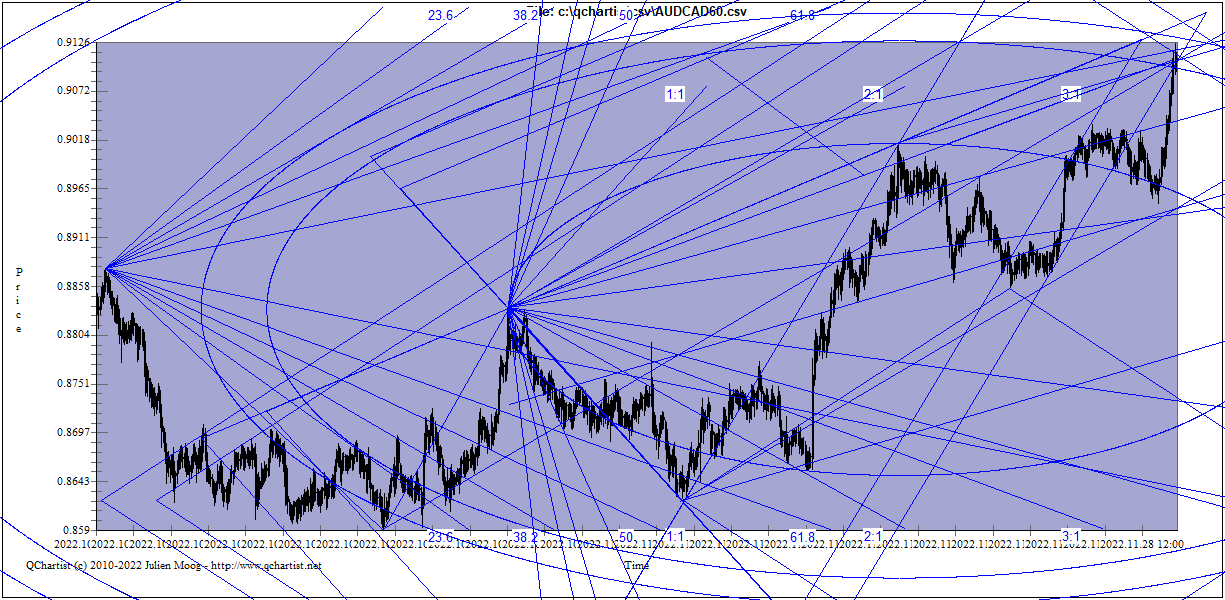

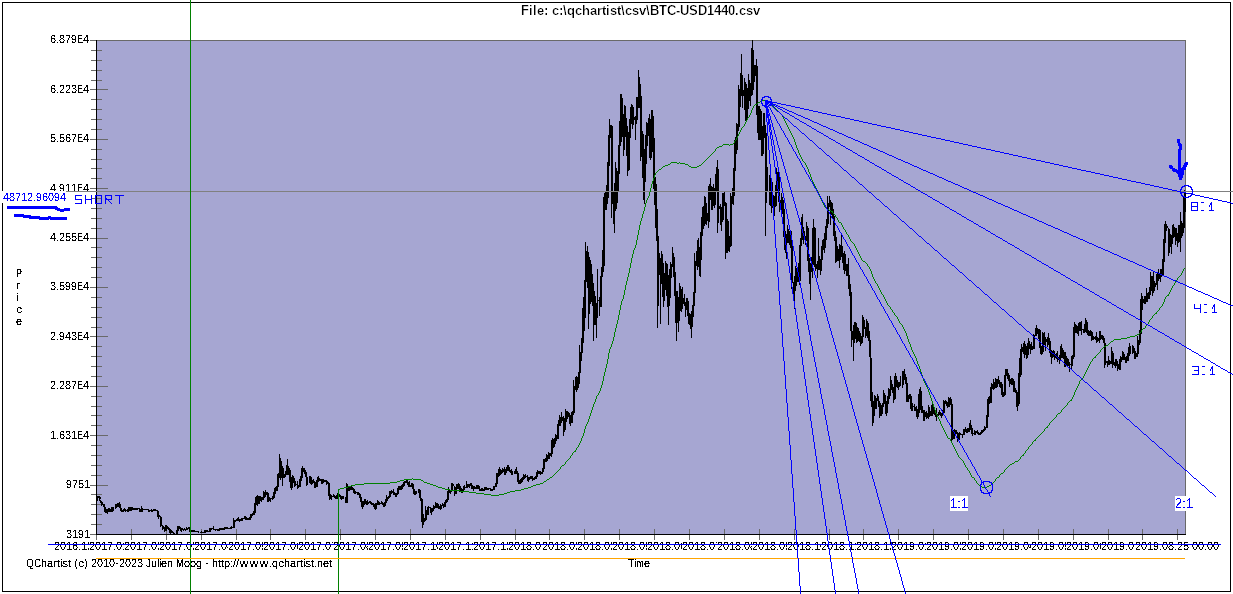

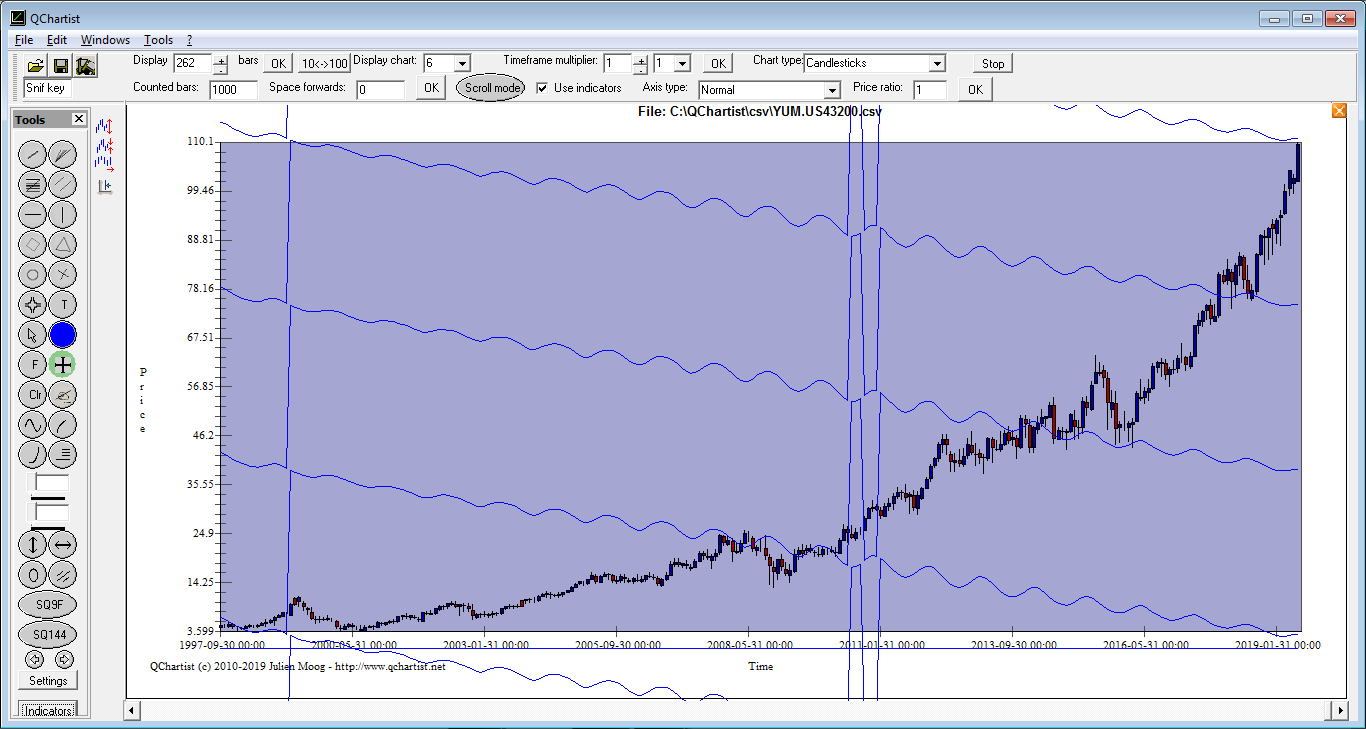

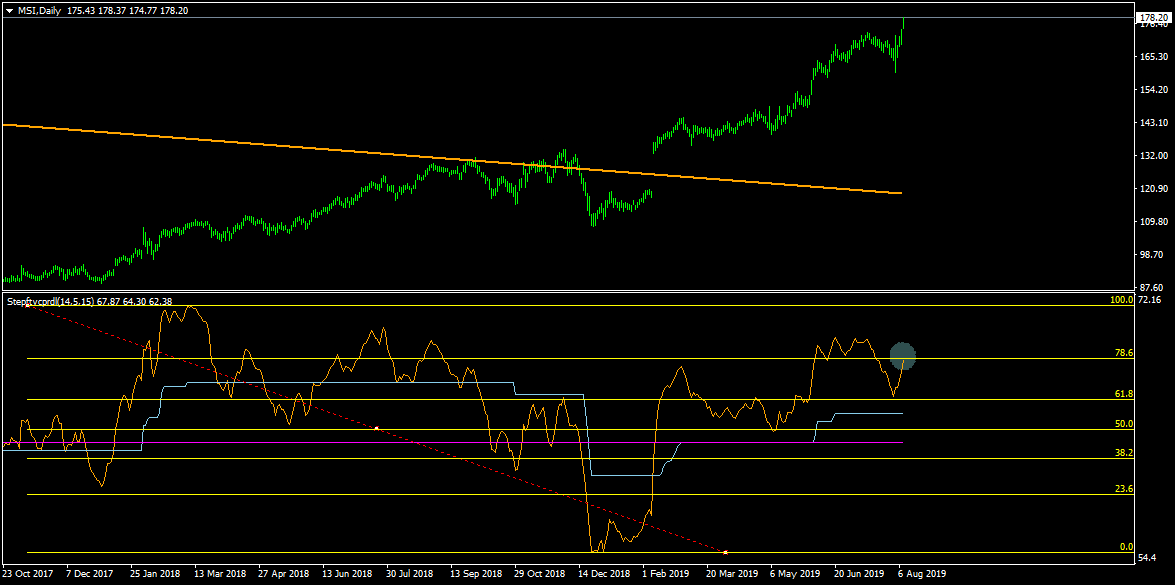

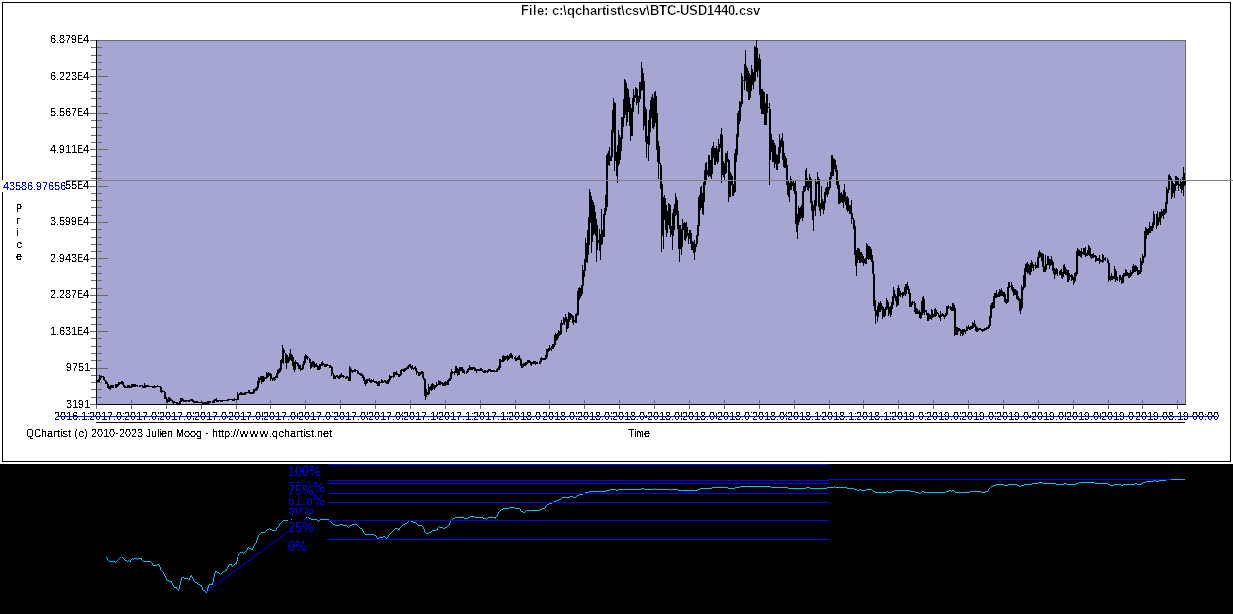

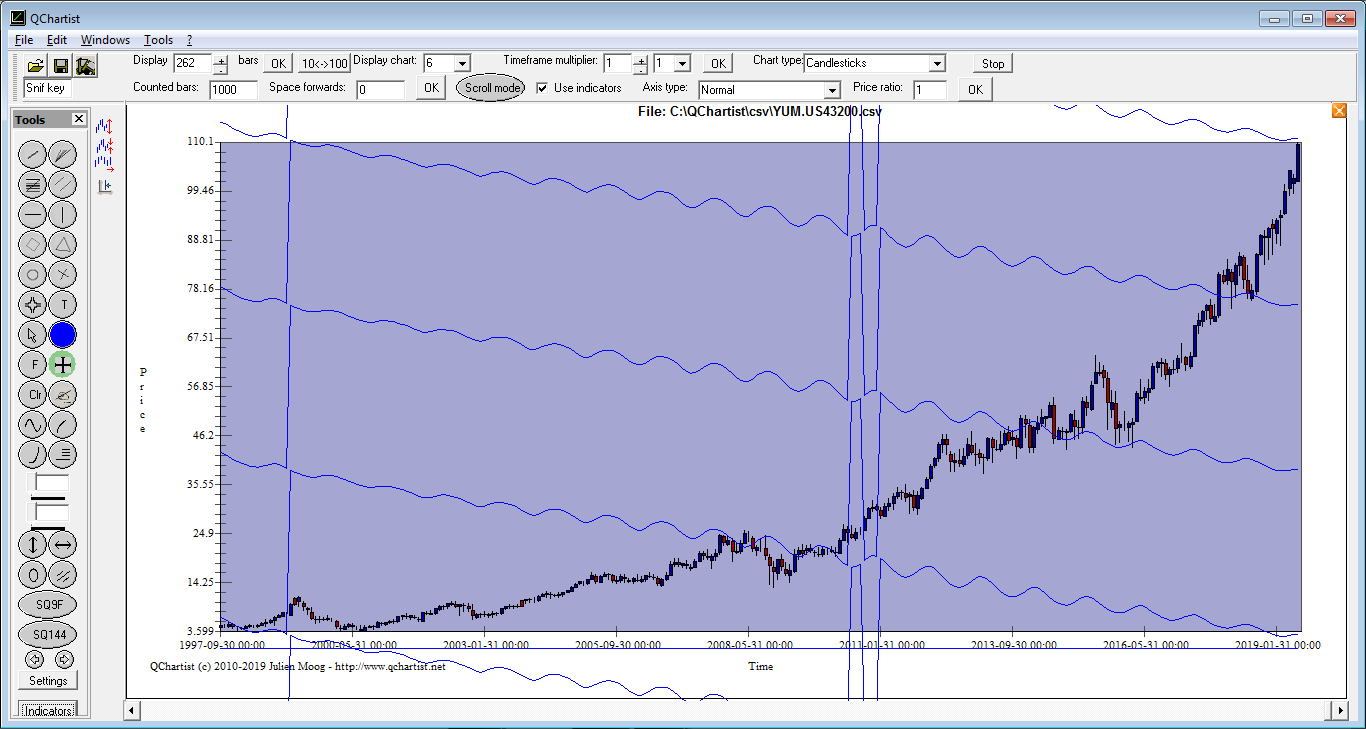

- Finally you can use StepRSI 225 and Stepftvcprdl with Fibonacci fans,

Fibonacci retracements, Pitchforks, and Fibonacci arcs on 1 hour to daily charts like that: (not required)

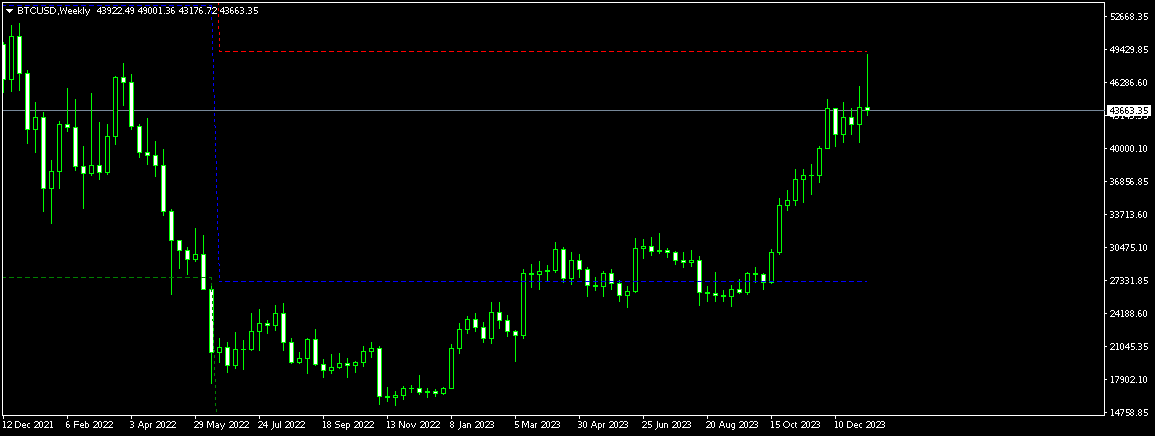

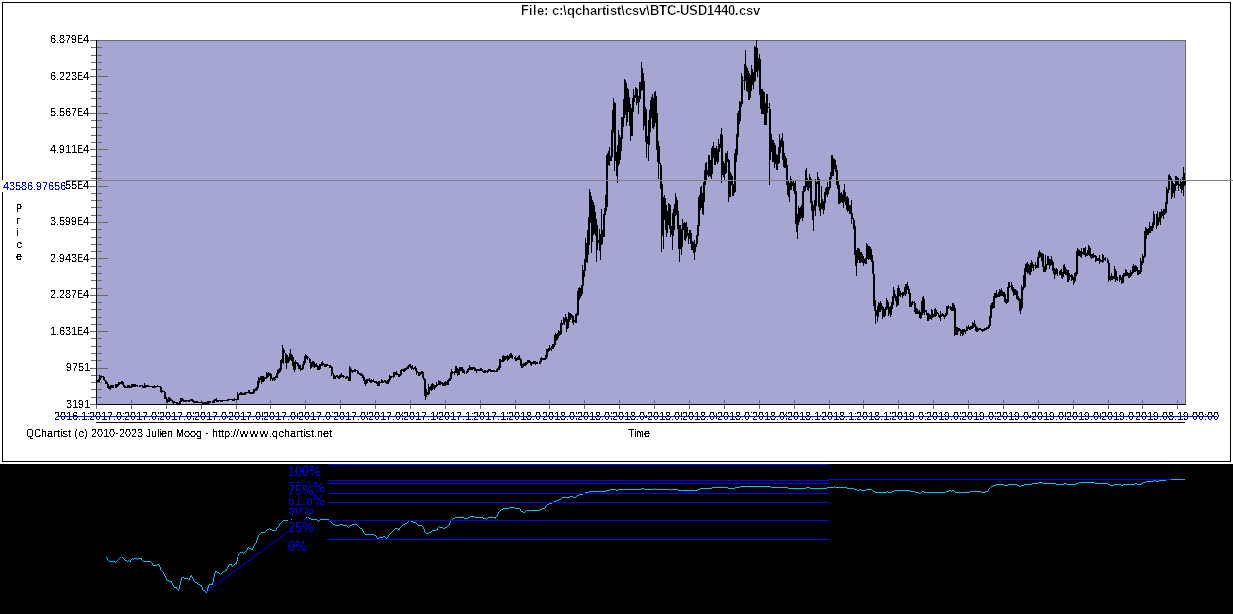

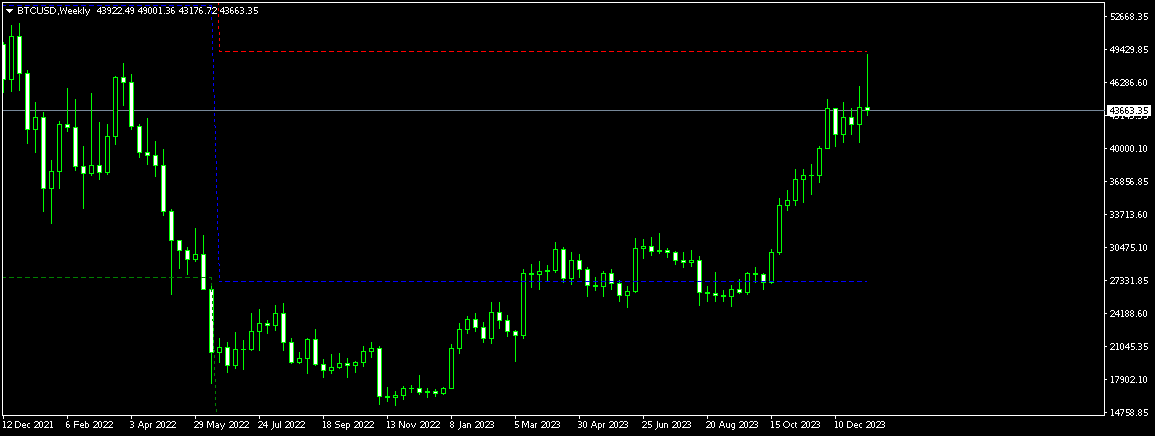

- tradingview.com has the best historical data. It's recommended to use it for long term view of the market. Here it is on Monthly charts: (not required)

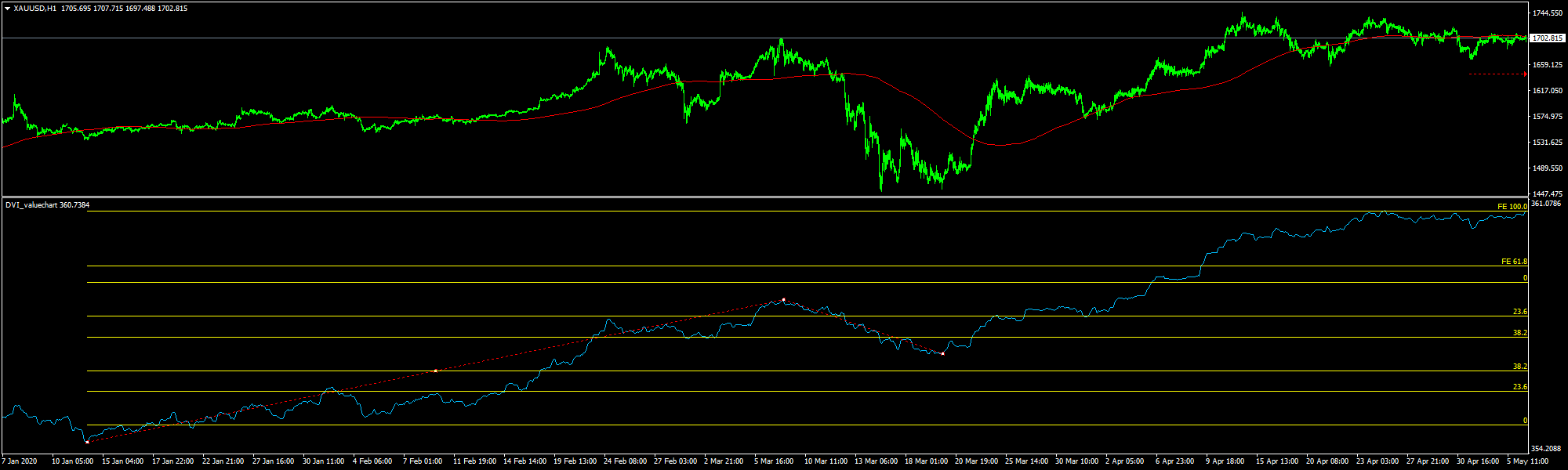

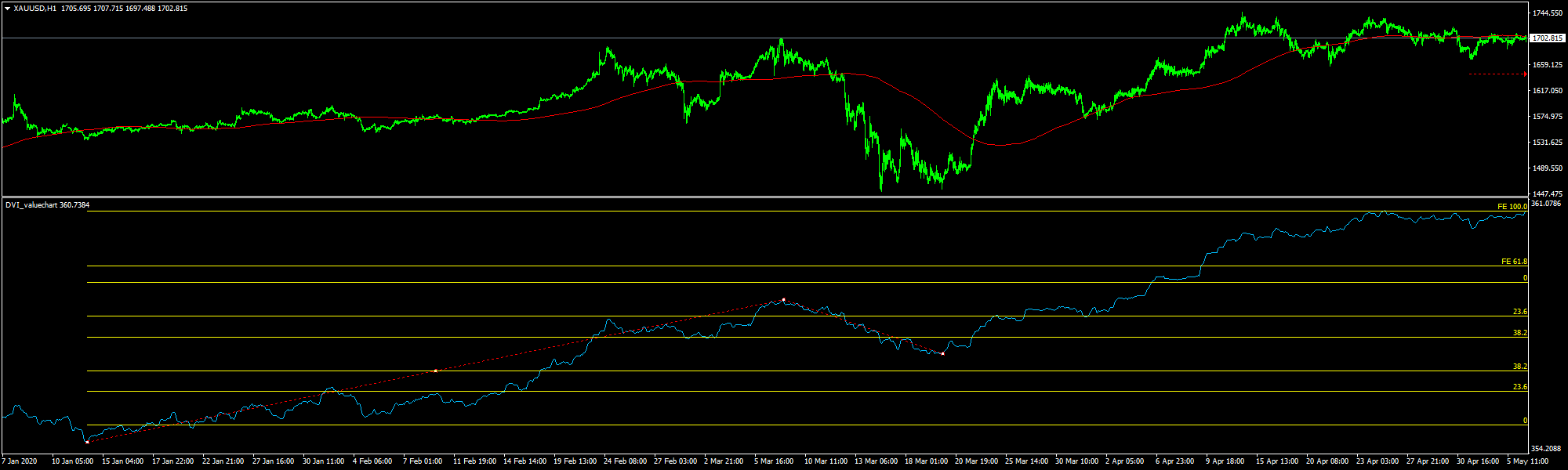

- DVI_VALUECHART with Fibo expansions (not required)

- With the Directional Volume Index indicator :

gold line must be > 0 and distant from 0 if we sell or

gold line must be < 0 and distant from 0 if we buy

Exit (Target Point) (please use H1 timeframe instead of H4):

With template 0tmacg:

- price reachs the Volatility.Pivot gray line

or

- stochastic 5,3,3 is near 20

or

- price reachs the Tma+CG middle dot line

Do not hesitate to use the PeriodConverter in MT4 Scripts if your TP becomes negative.

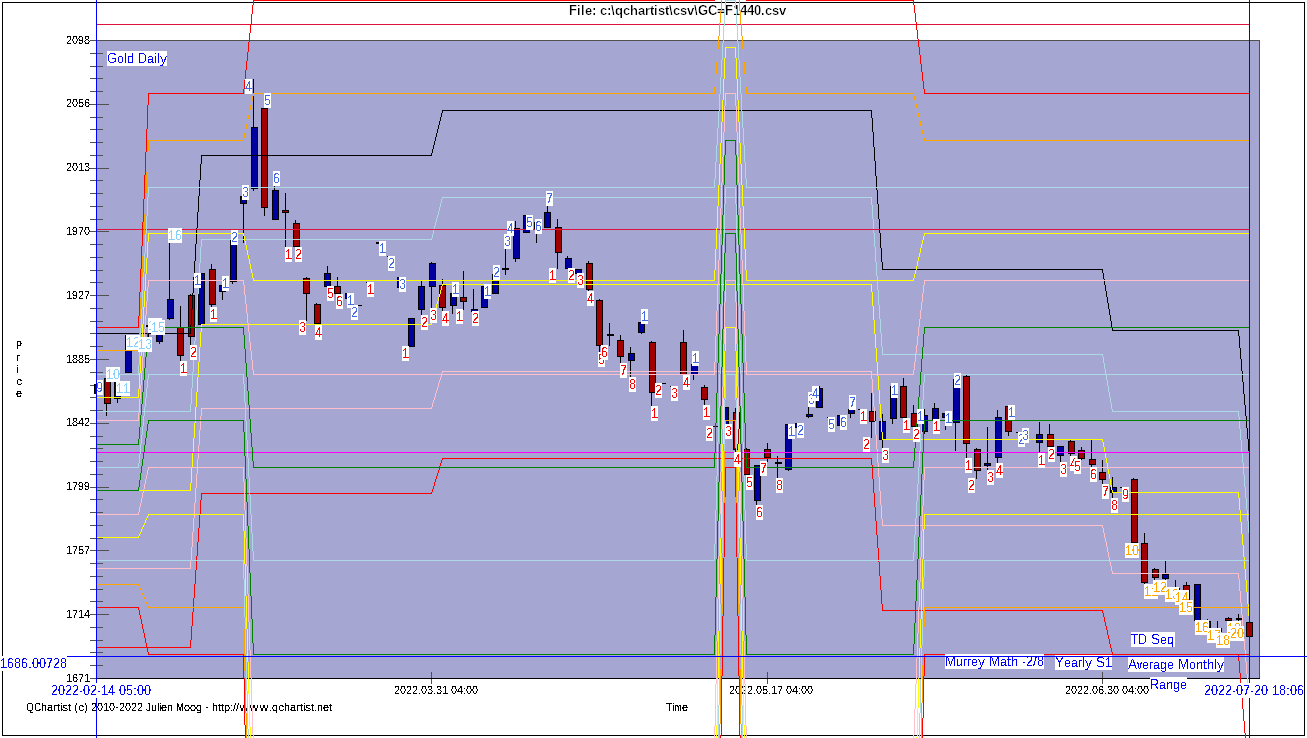

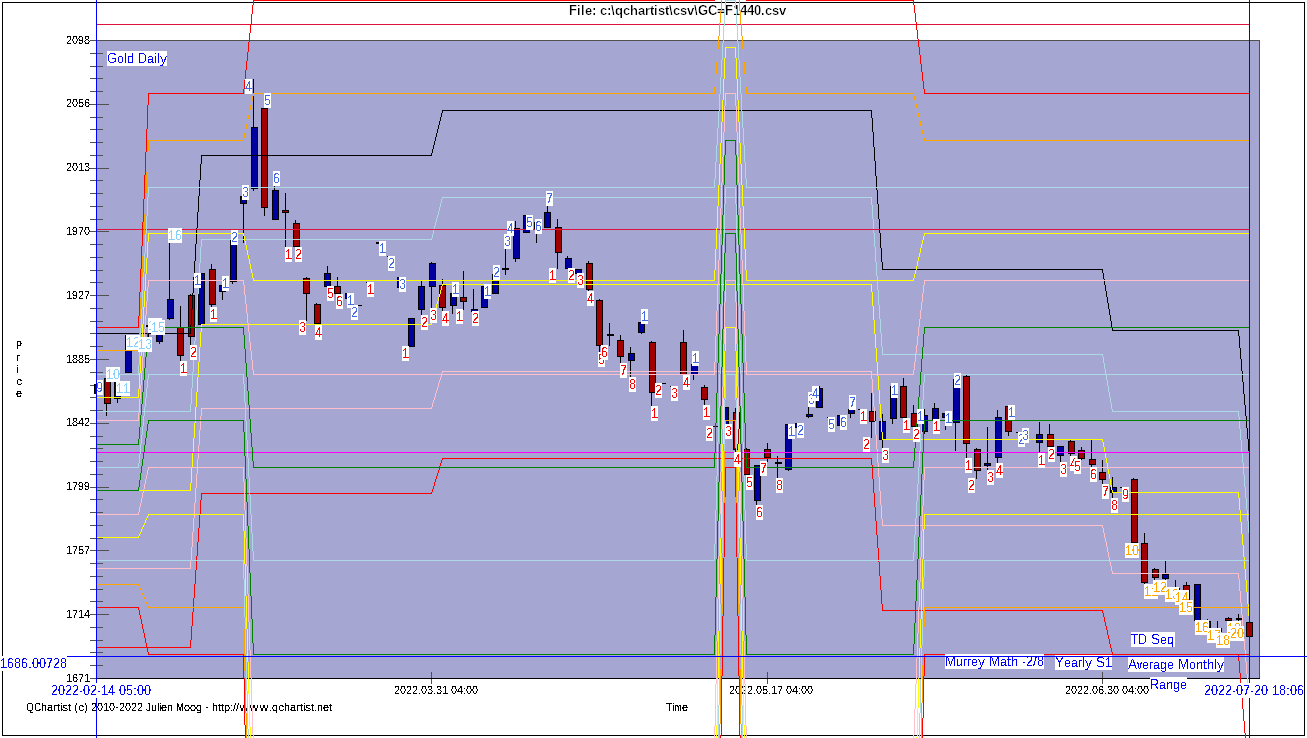

System #2 August 2022: System Sequential

This system is still under test phase but will give you more opportunities. It is much more simple. Use it at your own risk.

- TD Sequential is >=13 on Daily timeframe

- Optional: Price is near BB - HL Lower / Higher band on Daily timeframe

- Murrey Math on Daily timeframe is at least on the orange line + - 1/8

- Yearly Pivot Points indicator (MonthlyPivotcpp) max or min

- Average Monthly Range indicator (ADR Monthly) max or min

- Astro on Daily timeframe:

- Price bounce on Jupiter - Saturn Cycle

or

- Price bounce on PlanetSQN Chap 15

or

- Price bounce on Planet_Scale

- On Monthly timeframe:

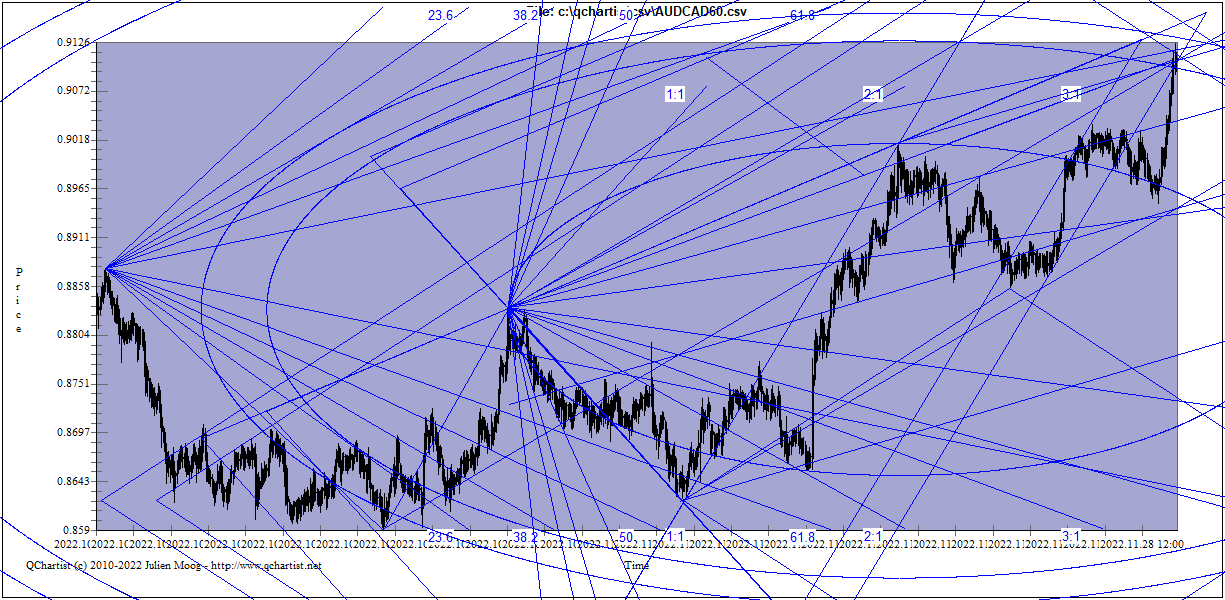

- Use price action with Drawing tools (Fibo Fans or Fibo Rets or Ellipse or Pitchforks or Grids or Speed Resistance Lines or Gann Fan or Schiff Pitchfork)

and

- Use price action with Drawing tools that require the "Lock Price Time Scale relationship" (Modify Axis Type to Fixed and set the Lock Price Scale Ratio value according to the number of Displayed Bars. Then you can use Square or Triangle or Circle or Pentagram or Square from Center or Triangle from Center or Fibo Arcs (modify settings) or Seed of Life or Fibo Circles or Speed Resistance Arcs)

Exit (Target Point) (Hourly timeframe):

- price reachs the Volatility.Pivot gray line

or

- stochastic 5,3,3 is near 20 or 80

or

- price reachs the Tma+CG middle dot line

System #3 November 2022: Price Action System with indicators

This system uses some indicators, and geometry in option. It will give you more opportunities. Use it at your own risk.

Here are the following objects that you can use:

(the more object you can draw efficiently, the more reliable will be your signals)

Works well on Forex, Indices, Crypto and Commodities.

We use Daily or Weekly charts with maximum number of bars (about 1000 bars).

We use scale independant drawing tools, here is the list:

- Trendlines

- Fibonacci Retracements (between 61.8 and 78.6)

- Parallel lines (use it imperatively)

- Ellipse (between 61.8 and 78.6)

- Andrew's Pitchforks

- Schiff Pitchforks or modified or inside in Settings

- Fibonacci Fans (with price mirror setting) (between 61.8 and 78.6)

- Speed Resistance Lines (with price mirror setting)

- Gann Fans (with price mirror setting)

- Gann Grids

- Oriented Cycles

- Triangle from 3 points (between 61.8 and 78.6)

- Fibonacci Rectangle method 1 or 2 in Settings (between 61.8 and 78.6)

- Fibonacci Diamond (between 61.8 and 78.6)

- Fibonacci Rotated rectangle method 1 or 2 in Settings (between 61.8 and 78.6)

- (Hathaway https://help.optuma.com/kb/faq.php?cid=21 https://help.optuma.com/kb/faq.php?id=423) Triple Vector Concentric Circle + Drawing Tool from the Center of the Circle (or Parallels or Trend Line at 32.70 degrees (= 90 degrees - 1 Radian))

With the "Circle Given 3 Points" drawing tool.

- Moreover, we can also use scale dependant drawing tools to complete the analysis

Here are the indicators that you can use:

- Murrey Math Daily or Weekly red lines (use it imperatively)

Use it on 4H TF only if you trade indraday (use it imperatively)

- DVI_Valuechart OR TSF 225 (see Useful tip below) Daily or Weekly with drawing tools (optional if intraday)

- Average Monthly Range (ADR 1.13) near pink or light blue line (optional)

- Center of Gravity and Past Regression Deviated 225 on Monthly chart (optional)

- Useful tip (use it imperatively) : use the Time Series Forecast (TSF 225) indicator on Daily or Weekly charts (increase bars back of the indicator and display 999 bars.) And draw "Gann Fan" or "Fibo Fan" with price mirror setting between Bottom - Top of the TSF curve in order to find turning points efficiently. Or with Fibo Retr., pentagram between bottom and top of TSF. (optional if intraday)

- Another powerful tool to complete the analysis is the use of the chart type Sinusoidal in the Menu Edit>Chart Conversions>Convert chart to Sinusoidal. On the Sinusoidal chart (varying from -1 to 1), we can use all scale independant and scale dependant drawing tools to complete the analysis. (optional)

- You can also use the Planet_Scale indicator on Weekly TF to find turning points. (optional)

- MogalefBands 4 Daily ,Weekly or Monthly (optional)

- Harmonic-Patterns, Search Patterns and Zup indicators (useful)

- Anchored VWAP channel top/bottom with all bars on 4H or daily TF (useful because it is self similar on all timeframes)

- Stochastic RSI (5,5,5) near 1/-1 on 4H TF (use it imperatively)

- CoronaTrendVigor Max/Min Flat -10/10 on 1H TF (use it imperatively)

- Spud2 >=90 or <=10 on 4H TF (use it imperatively)

- Price is near higher or lower band of DinFiboHigh cpp indicator on Daily TF (use it imperatively)

- You should also verify that the price is on top/bottom of Bollinger Bands and BB-HL and ATR Channel and Ma Chanels FiboEnv Mid and Din Fibo High and Past Regression Deviated Log on 5 min TF (use it imperatively)

- You should also verify that the price is on top/bottom of ATR Channel and Ma Chanels FiboEnv Mid indicators on 4H TF. (use it imperatively)

Exit when price is near Volatility.Pivot or when valuechart indicator is near 0 on 4H TF.

- If the price goes into the wrong direction, we wait for the price to reach the Murrey Math indicator +- 2/8 Ext Red Line on the 4H (240 minutes) timeframe ; and we enter again at that market price.

MogalefBands:

Time Series Forecast TSF with Gann Fans:

DVI_Valuechart with price expansions:

Murrey Math:

TMA_CG exit:

The system #3 nov 2022 is my favorite trading system and the one i use regulary. If

my trading systems and software helped you to become a successful

trader, please make a donation with the button below. Thank you!

Click

here to donate

free charting software free stock market software free stock analysis tools technical analysis software free download free technical analysis software free forex charting software free charting platform best charting software free charting tools best technical analysis software real time charting software open source technical analysis software best stock charting software best forex charting software free stock market analysis software best free stock analysis software best free technical analysis software stock analysis software free free forex chart analysis software open source charting software best trading chart software free trading chart software free stock charting platform best free stock charting software stock market technical analysis software free download best charting software for day trading free technical analysis charting software best free charting software best stock market charting software free chart analysis software professional charting software best chart analysis software best free charting software for day trading best stock market technical analysis software best free stock analysis tools free stock market analysis tools free chart software for stock market free charting software for stocks best charting software for trading

- You can look at ZUP for a butterfly (not required)

- You can look at ZUP for a butterfly (not required)