- major bug with the Data Source for ALL providers solved

- Added WolfeWave mode for Zup

Only ray trendlines are drawn on the chart

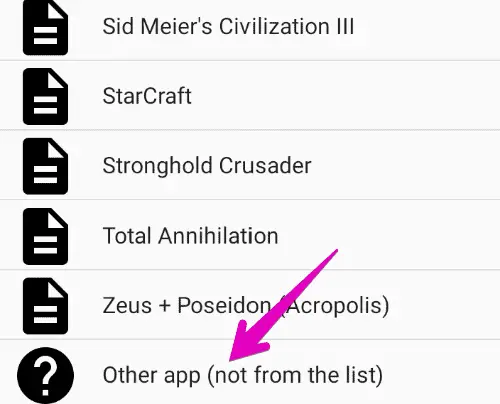

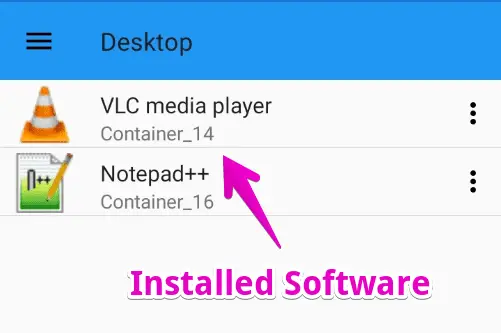

Run update or download the software on the official website.

Thank you for using our software.

Enjoy !

February 8, 2024

QChartist build 294 is available !

February 5, 2024

QChartist build 293 is available !

QChartist build 293 is available !

- Improved docs

- New harmonic patterns indis

- New functions and constants

- Major bug in Data Sources solved

Now all indicators work perfectly

Run update or download the last version from the website

Thanks for using our software.

Enjoy !

January 14, 2024

QChartist build 287 is out!

QChartist build 287 is out!

- new basic functions and subs : ObjectDelete, ObjectGet, ObjectCreate, ObjectFind, ObjectSetText, ihighest, ilowest, itype, iopen, ihigh, ilow, iclose, timeb

- new indicator : Harmonic_Patterns

Please run update and recompile with QTStart

Enjoy!

January 5, 2024

January 4, 2024

QChartist build 286 is out!

QChartist build 286 is out!

- new indicators: EhlersFourierTransform, istdevindicator (standard deviation indicator) and MogalefBands (uses the istdevonarray function)

- new indicator function: istdevonarray (stdev from array)

Please run update and recompile with QTStart

Enjoy!

December 26, 2023

QChartist build 285 is out!

QChartist build 285 is out!

- New Data Source

- Optimized systems in docs

- Hand cursor removed, the app no longer crashs, and the GUI is much more stable.

- Canvas bmp buffers debugged when undoing a drawing with a right-click

Please run update and recompile with QTStart

Enjoy!

December 11, 2023

Are you a freelance technical analyst ?

Are you a freelance technical analyst ?

Join my new Facebook group : https://facebook.com/groups/1063608981646278

#freelance #charting #stocks #stockmarket #crypto #BTC #Bitcoin #forex #FX #trading #finance #Ethereum #ETF #Indices

December 7, 2023

Your Turn To Multiply Dollars !

Your Turn To Multiply Dollars !

November 25, 2023

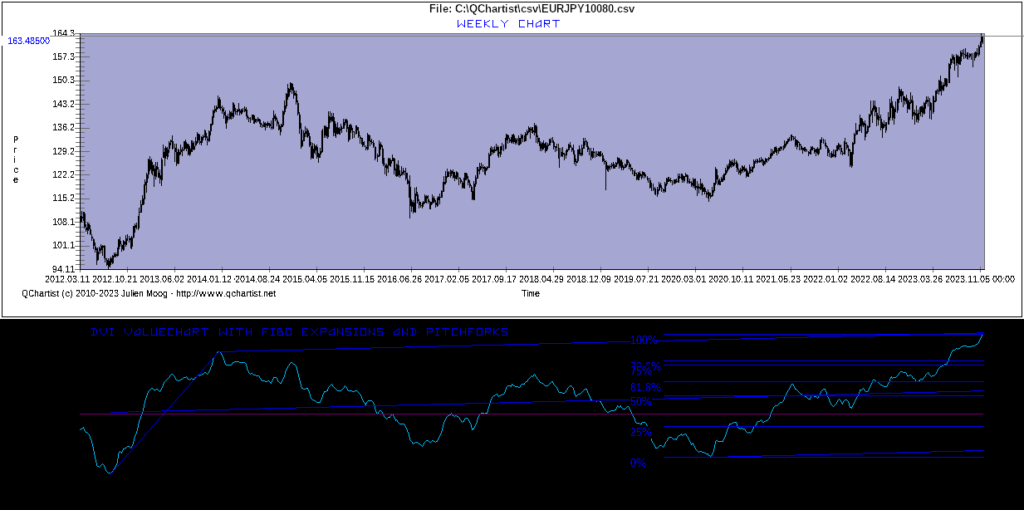

DVI_Valuechart indicator Weekly can be helpful

The DVI_Valuechart indicator on Weekly charts can be helpful to find major market reversals.

This indicator needs a volume information to work.

See the example below:

November 13, 2023

QChartist build 279 is out!

QChartist build 279 is out!

- Bug that limited the number of indicators solved. Now you can create and add new custom indicators, it won’t crash.

- New indicator : Anchored VWAP

- New indicator : Spud2

You can run update and recompile with QTStart

Enjoy!